Closing Comments

Craig Haugaard

May 26, 2015

After trading lower for four weeks or so we have seen the dollar catch fire once again the past couple of weeks and trade sharply higher. We have a very sharp rise in the dollar today and that put a great deal of pressure on commodity prices.

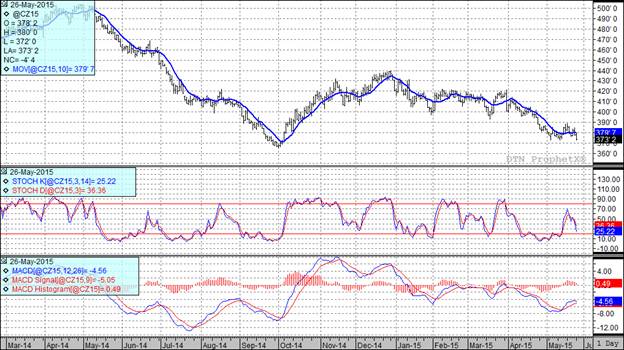

Corn:

I heard some folks today pontificating that the rains across the Corn Belt could cut corn acres and increase soybean acres. If memory serves me correctly I believe that in wet springs like this we could expect to see roughly one million acres of corn not get planted versus what the planting intentions were. Even if that is the case the conventional wisdom is that the current weather will result in higher yields which will more than offset any lost acres.

Speaking of corn planting and yield potential, after the close today we had the latest planting progress and crop conditions report. The report probably met or exceeded even the biggest bear’s expectations. The crop is now 92% planted versus the five year average of 88% planted. The crop is also 74% emerged which is 12% ahead of the five year average. Finally, the crop is currently rated as 74% good to excellent.

At the present time two of my three technical indicators are bearish both the July and December corn futures.

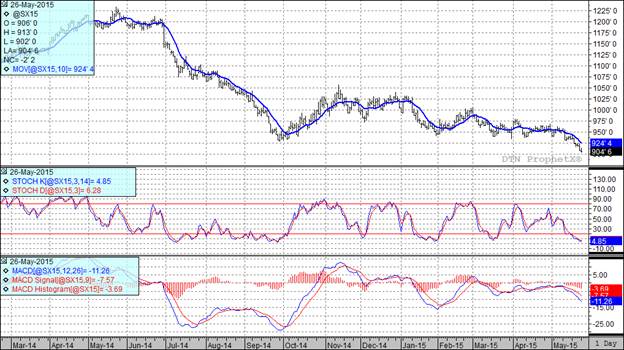

Soybean:

Beans struggled again today as they try to deal with record crops in North and South America as well as the thought that acres could be increasing this year over what the initial planted acres projection was. The conventional wisdom on the street is that we could see between one and two million more acres of soybeans planted this spring over what the USDA is currently projecting. Toss good growing conditions on top of additional acres and you can see why the funds want to sell this market.

Here in the USA planting continues at a rapid pace, in fact this afternoon’s report showed 61% of the crop planted versus the five year average of 55% planted. Thirty two percent of the crop is emerged which is also ahead of the five year pace of 255 emerged at this point on the calendar.

While the supply side of the picture looks bearish we are also seeing signs of concern on the demand side. The bird flu has had an impact on the demand for soybean meal while across the sea traders are keeping a close watch on China where it appears the economy is slowing. Many traders feel slower China economy could reduce the demand for soybeans. Since 25% of our crop ends up there this would be a very negative development.

At the present time all three of my technical indicators are bearish both the July and November soybean futures. If we have a big crop this fall I would not be surprised to see the new crop beans trade down into the $8.50 area if not lower. It should be noted that the stochastics are extremely low and when we get this low we tend to have a rally. If that occurs this time it may be short lived and will be viewed by professional traders as a selling opportunity.

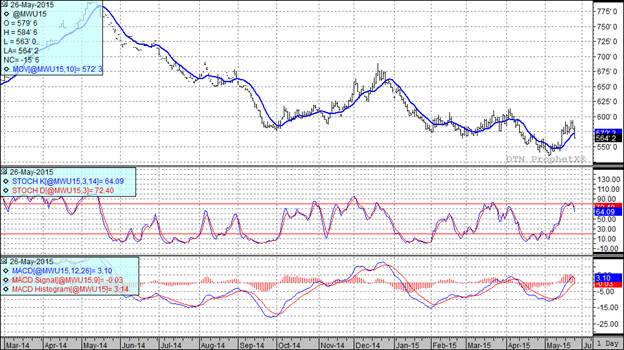

Wheat:

Wheat had a pretty tough day. The wet weather we are seeing across much of winter wheat country is expected to result in quality issues which will push some of this wheat into the feed market. That belief coupled with slow export demand resulted in aggressive selling today as funds sold an additional 11,000 contracts.

The crop conditions and planting progress reports this afternoon showed that 77% of the winter wheat crop is now headed out and is rated as 45% good to excellent. That compares favorably with the five year average of 67% emerged and last year’s rating of 30% good to excellent. In the world of spring wheat they have the crop pegged as 96% planted, well ahead of the five year average of 79% planted. Eighty percent of the crop is emerged versus the five year average of 54% and the crop is rated as 69% good to excellent which is up 4% from last week.

An extremely rough day in this market has two of my three technical indicators bearish both the Minneapolis and Kansas City July and September futures.

Top Trending Reads: