Closing Comments

Lynn Miller

May 27, 2015

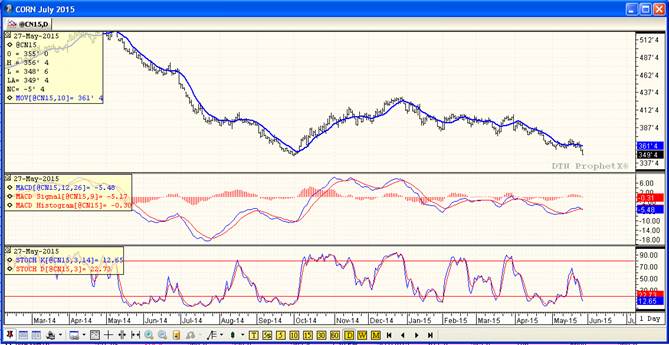

Corn:

It appears corn just can’t get away from the same old/same old lately. Very limited fresh news outside of some updated forecasts. The US farmer continues to hold tight while the SA farmer is selling. The change in weather from hot/dry to cool/wet has helped crops progress rapidly as of late. However, some areas that are too wet are now looking at moving acres to beans. On a normal year we would see this as a plus, but weather conditions appear to be favorable enough right now to make up the acre gap in production.

Demand continues to be routine; however, strength in the US dollar will continue to make fresh export business difficult. Lack of any real threat will keep this market at depressed. Funds were net sellers of 11,000 contracts today.

Technically all three indicators are once again bearish. The stochastics have entered oversold territory. Look for support at the $3.47 contract low put in the 1st of October. Resistance, if we should get a bounce, would be at $3.80 and $3.90 respectfully.

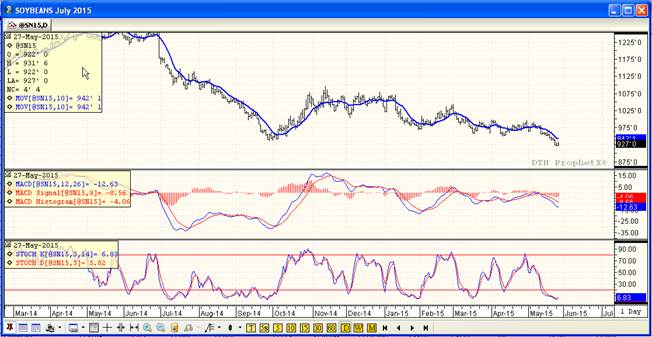

Soybeans:

Beans and meal were the two lone commodities to trade to the plus side today. Beans closed well of session highs, but none the less higher. This market was due for a bounce after losing over $0.50 in the past 10 sessions. News of the Argentina crushing workers strike is spreading outside of Rosario gave some underlying support, but it appears not all are convinced this will be on going. Many feel there will be agreements met when the labor union meets with government officials this afternoon.

Good weather and a great start to the US crop is providing overhead resistance. The trade continues to debate if soybean acres will be increased from the 84.6 million USDA estimate.

Technically, two of three indicators remain bearish at the present time in old crop beans. The stochastics are signaling a buy in oversold territory with today price action. We have been running below the moving average now since May 12th, and you would think we would be do for at least a technical correction. If we can get this thing turned around, we have probably established a new line of support here @ $9.21, if not we are likely going to test $8.54. In the event of a bounce, I would be ready to put some sales on at $9.88 and $10.10.

Wheat:

We ended last week with traders liquidating a record net short position on concerns the wet US could reduce the quality of our wheat crop. This liquidation pushed us through the 20, 50 and 100 day moving averages. In just two days we have taken all that back as crop ratings improve, we see some relief to dryness in the Canadian Prairies and news the Russian crop is better than expected.

All three wheat markets failed today at the 20-day moving average to hold support. The technical structure of these markets looks very weak.

Technically, two of three indicators are bearish the old crop Minneapolis futures. Price action Thursday and Friday took us right up to resistance of $5.85 and then Tuesday’s crop condition reports took us down the past two days. We have traded straight south through the $5.60 support line and are now looking to $5.22 to stop the slide. The stochastics are currently in pretty neutral territory while the while the MACD is hanging onto the buy side.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: