Closing Comments

Lynn Miller

May 28, 2015

Unification Meetings are now scheduled. Plan to Attend / Be Informed / Every Vote Counts.

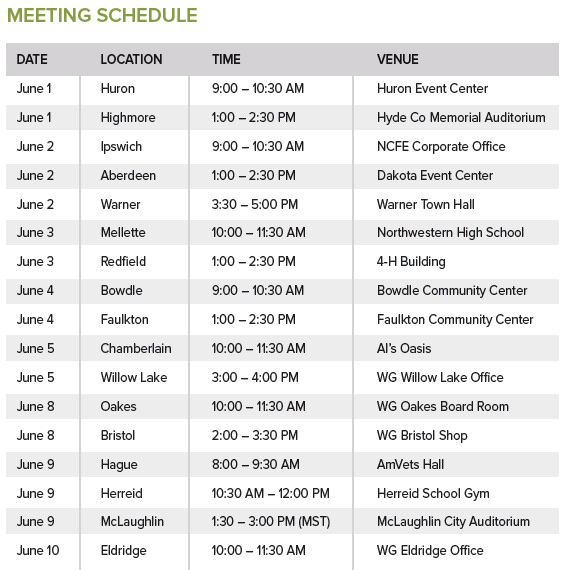

Corn:

I don’t know about Craig, but I’m running out of ways to say the same things every day. At least with lack of much for news, we got some ethanol numbers to talk about today. This week is the biggest crush number since February at 101.7 million bushels, good for corn. Ethanol stocks were down, good for corn. The dollar was weaker, good for corn. So at least we had a few things working for us today.

Corn sales tomorrow:

Old Crop estimated between 550-750 mt vs 812 last week.

New Crop estimated between 100-300 mt vs 81 last week.

End user buying is up this week.

Technically all three indicators remain again bearish. However, today’s action has the stochastics pitching towards a buy signal in oversold territory. Did we establish support here at $349? I sure hope so, but if this should fail look for this market to test $3.17. Resistance, if we should get a bounce, would be at $3.80 and $3.90 respectfully. I would be ready to make sales in this area.

Soybeans:

Beans just have nothing new. We continue to see depressed markets with everyone focused on big supplies getting bigger, slowing Chinese demand, increase Brazilian selling.

About all we have left on the horizon is the strike in Argentina, but I heard they may have resolved this overnight. That leaves not much other than slow farmer selling and increased crush margins to support this market in the short term.

Bean sales tomorrow:

Old Crop estimated between 150-300 mt vs 165 last week.

New Crop estimated between 100-300 mt vs 77 last week.

Technically, two of three indicators remain bearish at the present time in old crop beans. The stochastics are still signaling a buy in oversold territory after today, but they haven’t really moved much. We continue to run below the moving average; however we did try to close that gap some today. The $9.21 support I was hoping we established yesterday did hold up for us today. I hoping it will continue to hold, but you can’t rule out testing $8.54 in this market environment. In the event of a bounce, I would be ready to put some sales on at $9.90 and $10.10.

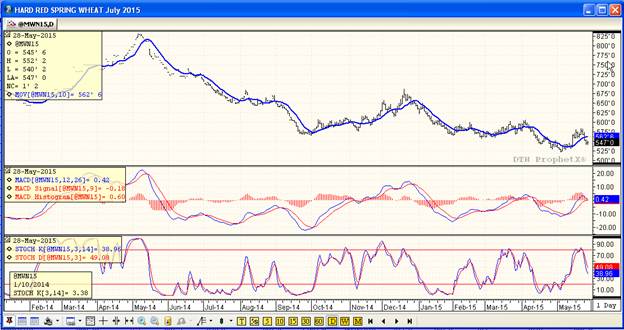

Wheat:

Wheat was a mixed bag today with small news on either side of the market. Egypt bought wheat, but, from cheaper origin Russia and Romania, bad for US Wheat. Russia lowered their production and export number for 2015, good for US Wheat. Canada need rain, but it’s forcast, therefore this is pretty neutral. And, US Soft Red Wheat quality is dropping, but lack of export demand will keep this a neutral factor for now.

Wheat sales tomorrow:

Estimated between 100-300 mt vs 128 last week.

Technically, two of three indicators are bearish the old crop Minneapolis futures. The MACD is the only indicator that is stubbornly bullish at the moment. The $5.22 contract low put in yesterday did prove to stop the slide, at least for the day. Should that fail we are looking at $4.58. I would be ready to make sales at the $5.85 level if we could must our way back up.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: