Craig’s Closing Comments

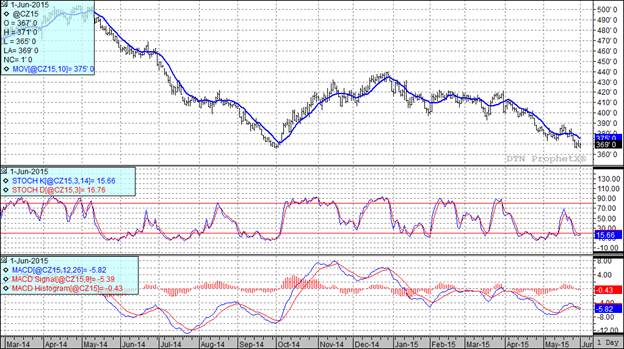

June 1, 2015Corn:

It was a very slow day from a news standpoint. We had weekly export inspections were check in at 38.4 million bushels. The trade was looking for something in the 33.5 to 41.3 million bushel range so we fit within that but were down slightly from last week’s 37 million bushels of inspections.

After the close we got the weekly planting progress and crop conditions reports. The corn crop is officially 95% planted with 84% emerged. The crop is looking real good with 74% currently rated as good to excellent. Last year at this point the crop was 76% good to excellent so the trade looks at this and assumes that we could be looking at another trend line yield or better if all goes well the next couple of months.

In South America I see that Brazil has begun their corn harvest with early reports stating that it looks pretty good.

At the present time all three of my technical indicators are bearish both the July and December corn futures.

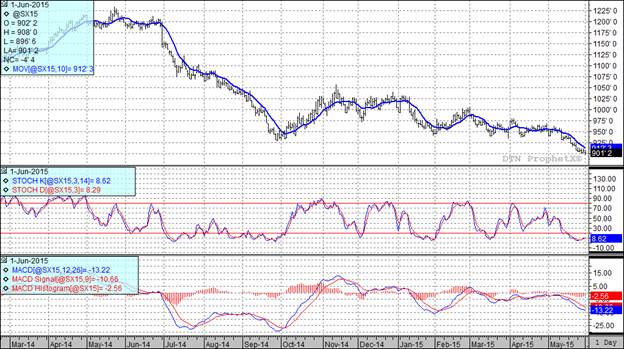

Soybean:

Weekly export inspections were disappointing for the week. The trade was looking for inspections to fall in a range from 5.5 to 10.1 million bushels so the actual number of 2.7 million bushels was disappointing. It is also the worst weekly export inspection number we have seen since last September.

On the bullish side of the ledger some folks tried to create a bull story out of the freeze that hit the canola crop in Canada over the week-end. It pushed canola prices higher in that nation but obviously had little to no impact on our bean market.

This afternoon’s planting progress report showed that in spite of a wet week in many parts of the Corn Belt progress is still being made. The crop is currently pegged at 71% planted with 49% of the crop emerged.

In a classic case of a big crop getting bigger recent estimates of the Brazilian soybean production now stand at 93.06 MMT, up from the recent USDA estimate of 92.69 MMT.

At the present time two of my three technical indicators are bearish the November soybean futures while all three are bearish the July futures.

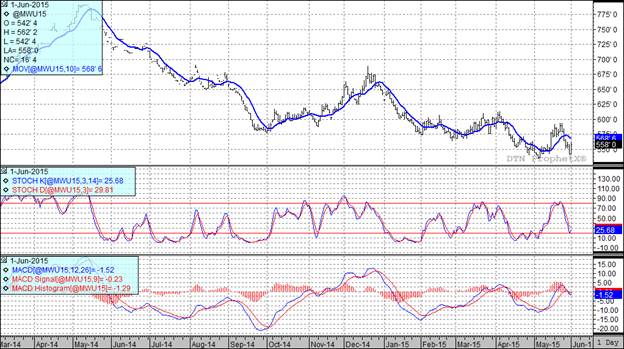

Wheat:

We had a big day in the wheat market as seemingly traded higher for three reasons. First and foremost was the fear of damage done to the wheat crop in Canada as a result of the freeze over the week-end. Secondly, the market was supported by the belief that this afternoon’s crop conditions report would show a decline in the winter wheat condition as a result of the heavy rains. Finally, we traded higher on profit taking as some traders wanted to take money off the table on the heels of Frida’s probe down toward contract lows. If I had to guess I would say that today’s bounce was a great selling opportunity but time will tell.

Weekly export inspections certainly didn’t offer any great stimulus, the came in at 13.2 million bushels which fit nicely in the trade estimates of 9.1 to 14.7 million bushels.

The planting progress and crop conditions report were kind of interesting. Traders that I had spoken with expected the winter wheat conditions to be down 1% from last week and at 44% good to excellent that is exactly where they are this evening. A year ago at this point the crop was rated 30% good to excellent. The vast majority of the winter wheat is headed. In fact with 84% of the crop headed we are well ahead of the five year average of 77% headed on this date. Turning to spring wheat 91% of that crop is now emerged, well ahead of the five year average of 69%. The crop condition seems to be doing well as it is currently rated at 71% good to excellent. That is up from last week’s rating of 6% good to excellent.

In spite of a sharply higher day all three of my technical indicators remain bearish both the Minneapolis and Kansas City July and September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: