Craig’s Closing Comments

Lynn Miller

June 3, 2015

The vote is only 2 weeks away.

Plan to attend a unification meeting. Be Informed, every vote counts.

Corn:

News in the corn world was pretty minimal, but we do have a few things to mull over. First out of the gate today was ethanol production. Crush is up from last week @ 102.06 million bushels – that’s two good weeks in a row!. Stocks were down and margins slipped a little bit, but remain positive.

The overall tone of this market remains negative, although, there are a few things to keep an eye one. One, would be the acres left to plant. Like in the areas of Kansas, Missouri, Nebraska and rain soaked Texas. The market thinks there could as many as 1.5 million acres left to plant vs. intentions. Now that could be a gap. Another is the crop condition. As of now we are rated nationally 74% good to excellent vs. 76 last year. But, we only have nicer crops in Illinois, Indiana and Ohio. Crops are lagging in Iowa, Nebraska, Minnesota, N Dakota and S Dakota. Then there’s the American farmer. He’s not selling and sitting on records stocks of 2014 crop while not marketing 2015 either. For the time being, we are building in our own resistance as the farmer continues to hold.

As we look forward to Export Sales tomorrow – trade estimates are 550-750 mt of old crop and 100-300 mt in the new crop.

Technically, all 3 indicators are currently bullish both the old and new crop corn. I see $3.68 and $3.80 as selling opportunites in the July futures while, $3.83 would be the first level of resistance in the new crop.

Soybeans:

World stocks helped put some pressure on the bean market today as Informa raised their 2014/15 2.0 mmt due to larger Brazil and Argentina crops. Also rumor out there that China feed users may have defaulted on open soymeal contracts.

Plantings at 71% complete vs 70 so pretty much right on track for an average; however, we are behind in Kansas, Missouri, Nebraska, Iowa and Illinois. Normal summer weather will continue to carry the market lower.

As far as tomorrow’s export expectations the market is looking for 150-350 mt old crop and 50-150 mt new crop. With the day chart in tack and trending higher, export sales tomorrow will probably control the days market direction.

Technically all three indicators remain bullish both the old and new crop beans. In the old crop, look for selling opportunities at $9.60 and $9.88. While in the new crop we would be looking for $9.35 and $9.60.

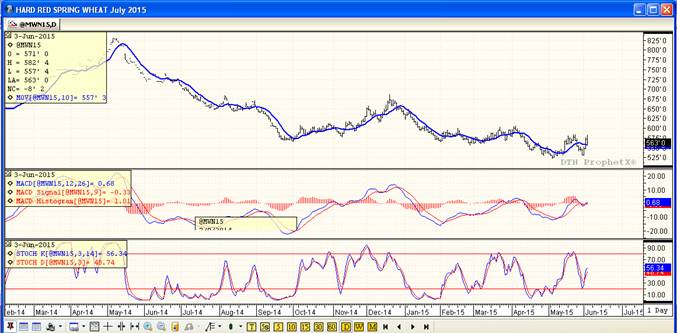

Wheat:

Wheats had an interesting day. Trading right up to resistance on news that trouble was once again brewing in the Ukraine. News hit Rueters at 8:55 this morning that ‘A senior rebel commander said around 15 fighters and civilians had been killed as a result of clashes between Ukranian government forces and the seperatists near rebel-controlled Donetsk”. If you attended our winter marketing meetings, Craig told you to keep an eye on Putin for some market action (but advised this was not a good marketing plan). Although, not a plan, if you had orders laid in at the resistance point of $5.84 – you made sales today.

Other things on the horizon: Dry weather in the European Union, Canada and Australia and ongoing quality concerns in rain soaked regions of the US.

Export sales tomorrow expect to be between 200-400 mt vs 253 last week.

Technically, all 3 indicators remain bullish both the old and new crops on weakening technical with this afternoons price action. In both the July and Sep futures we traded from resistance to support in one day closing at the bottom end of the range and right on support to test tomorrow. In the July, we have selling opportunities at $5.84 and $6.04 with support at $5.61, while in the Sep we are looking at $5.92 as a selling point and $5.70 as support. Here’s hoping we can tow the line tomorrow.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: