Craig’s Closing Comments

Craig Haugaard

June 8, 2015

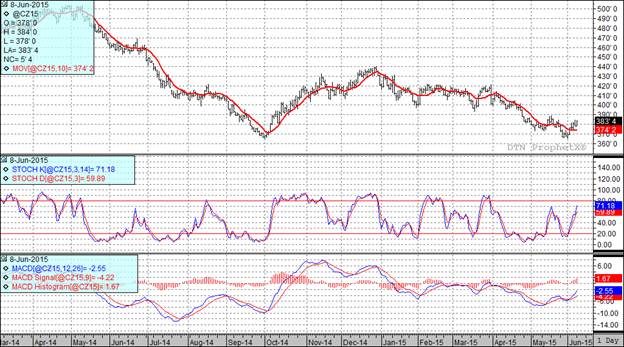

Corn:

We saw corn trade higher again today on spillover strength from wheat and a weaker USA dollar. We probably also were seeing some position squaring ahead of Wednesday’s USDA report.

This afternoon we got the weekly crop conditions report. It was left unchanged from last week at 74% good to excellent. A year ago we were at 75% good to excellent at this point. The planting delays in this market has gotten a lot of attention and while the USDA report today didn’t include a total % planted we did still have some individual states still reporting planting progress. Colorado reported at 95% complete versus 79% last week, Missouri reported at 90% complete versus 87% last week, Kansas checked in at 93% planted versus 86% last week and Texas is at 93% planted versus 83% last week. The crop is 91% emerged versus the five year average of 90% emerged. While crop conditions may not have improved all that much with last week’s rain events, there could be significant improvement this week with forecasts for warmer temperatures throughout much of the Midwest.

The weekly USA export inspections came in at 29 million bushels. That was down from 39 million last week and 45 million last year.

At the present time all three of my technical indicators are bullish both the July and December corn futures.

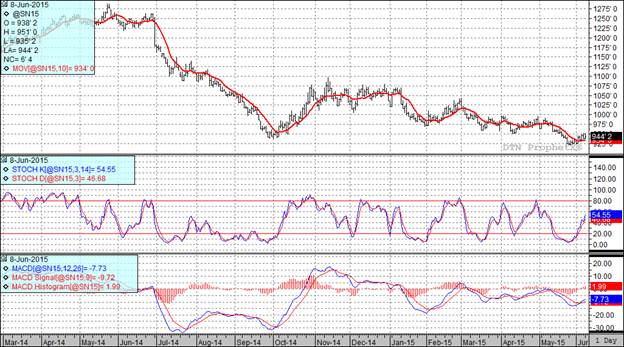

Soybean:

The soybean market traded higher over concerns that the excess moisture will keep acres from being planted.

Weekly soybean export inspections were announced at 8 million bushels. This was above the trade’s expectations as well as being stronger than the 4 million posted on this week a year ago.

This afternoon the crop progress report was out showing that 79% of the crop has been planted, slightly trailing the five year average of 81% planted on this date. At this point 64% of the crop is emerged which is about in line with the five year average of 63%. The crop is not rated quite as good as it was a year ago with 69% currently rated as good to excellent versus 74% in that category a year ago. Again, a week or so of warm and dry weather would be expected to increase the percent of crop with that rating.

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

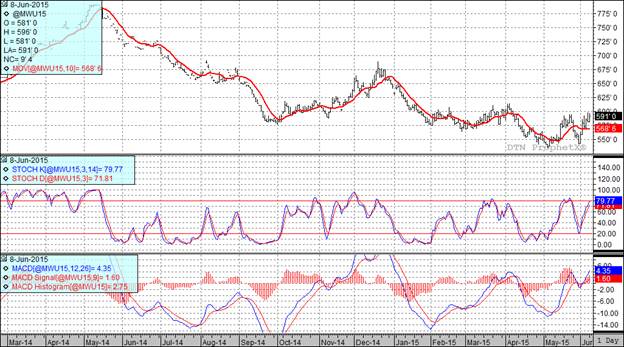

Wheat:

The wheat market traded higher on crop concerns as a result of the recent heavy rains in the USA southern Plains. The weakness in the USA dollar was also supportive to prices. Winter wheat harvest has begun in some areas with early reports of light test weight (56-57 pounds) and signs of damage to the crop. In fact, according to this afternoons report 4% of the winter wheat crop is now harvested, off from the five year average of 12% harvested as a result of the recent rains. We also saw some report as a result of concerns over dryness in Europe, France, Canada and Russia. There are better chances of rain this week for Canada, Europe and Russia which could help alleviate that concern. On the other hand the USA spring wheat crop should be living large as a result of the cooler weather conditions.

The winter wheat is currently pegged at 43% good to excellent, down 1% for the week but well ahead of the 30% in that category a year ago. Spring wheat is rated at 69% good to excellent versus 71% good to excellent last week and a year ago.

Weekly USA export inspections were 11 million bushels vs 20 last year. This was towards the bottom end of trade guesses.

All three of my technical indicators are bullish both the Minneapolis and Kansas City July and September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: