Craig’s Closing Comments

Lynn Miller

June 11th, 2015

Upcoming reports:

June 12th – Informa updated planted acres

June 30th – USDA June 1 Stocks Report – updated planted acreage and quarterly stocks.

Corn:

Well it was a report hang-over day today with commodities in general remaining on the defensive. It is presumed a large amount of today’s market pressure was the unwinding of corn/wheat spreads. All in all, the funds remained net zero on their corn position at the closing bell.

Export sales numbers were out at 495 tmt of old crop sales and 115.5 tmt of new crop sales. Both numbers were at the lower end of the trade guess.

Conab is raising the Brazilian corn crop estimates.

The US Senate Agriculture Committee announced that it would launch a hearing on the Bird Flu outbreak July 7th.

Not much else out there for news today.

Technically 2 of 3 indicators are currently bearish both the July and the Dember with only the MACD lagging. Support in the July sits at $3.48 with resistance at $3.68 and $3.80. It just amazes me how these markets will follow the retracements lines as we traded right up to $3.68 on the 8th and 10th while we waited for numbers from the USDA. This is a good method to help you make some sales.

Soybeans:

First on the docket today was weekly export sales and the numbers weren’t too bad. Old Crop commitments came in at 164 tmt, with 389.3 tmt in new crop, both numbers above trade expectations.

Conab raised Brazilian bean production – yet again.

Rosario grain exchanged raises Argentina production.

May NOPA crush numbers will be out Monday with the trade looking for a hearty 147.3.

Technically 2 of three indicators remain bullish for the July with support at $9.20 and resistance of $9.50 and $9.68. In the new crop, 2 of 3 indicators have turned bearish. We are looking to $8.98 for support with resistance at $9.23.

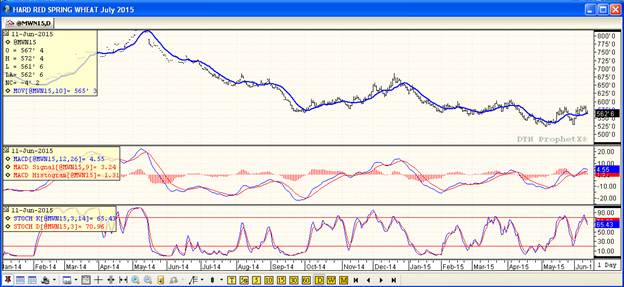

Wheat:

Follow through selling from yesterday’s USDA report coupled with additional pressure from the unwinding of corn/wheat spreads pushed us lower today. Adding insult to injury, a spot tender by Egypt went to Russia at prices well below the US.

Wheat export numbers today came in at the higher end of expectations at 376.7 not too shabby for the start of a new crop year.

Technically, 2 of 3 indicators remain bullish the nearby spring wheat. We closed just above support of $5.60 for the day with resistance at $5.85 and $6.04. We need $5.60 to hold in order to find traction for another up move.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: