Craig’s Closing Comments

Lynn Miller

June 12th, 2015

I keep trying to put my finger on this market, and I have been really unsuccessful. It seems there is not enough of a ‘price’ in here for anyone to get in now and make money off the board, but nevertheless, you can still do it wrong and lose money. Most of the action we see lately is driven by the funds and their desire to see the market move. Maybe we can’t out guess them, but we can be watching the numbers and making sales at technical levels so we don’t miss out on whatever ups we can get them to give us.

Corn:

China was talk of the town today, for two reasons. First, they are talking of cancelling or rolling-over DDG sales and second, there is talk they will be cutting the new crop subsidies for corn.

The DDGs. So far, the cancellation has been only 2 cargoes, but talk is they will roll additional purchases to fall so they can take advantage of harvest basis levels. This news alone brought the DDG market down $15/short ton over the course of the week. On the first DDGs were bringing $200, $187 on Monday and now $170 with the Iowa market only bringing $160 (the lowest price of the year). As prices continue to fall, you can feel the presence of supply being put ‘back into the market’.

As for the subsidized corn price, the affects there are two fold. They initially increased their government support price to increase rural incomes. And it has. Domestic Chinese corn is now price 30% higher than the world market. That has been good for us, increasing export business as overseas grain was cheaper. However, it has definitely stressed their interior supply. This ‘stockpiled’ corn is expensive and of relatively poor quality so their mills do not want it. Bringing these prices down will probably bring down US export numbers.

The only other thing left to trade, if we take China out of the mix, is weather. Yes, we may be getting too wet in parts of the US, but I get the feeling the market is still of the mindset “rain make grain” for the time being.

Technically, all three indicators are now bearish the July corn futures while 2 indicators continue to be bearish the New Crop. Look for nearby corn to test support of $3.48. Turning this market to the upside would have me looking for $3.68 to make additional sales on binned bushels. In the New Crop, look for support at $3.65, while $3.80 would be my first target for making some catch-up sales if you have nothing on the books yet.

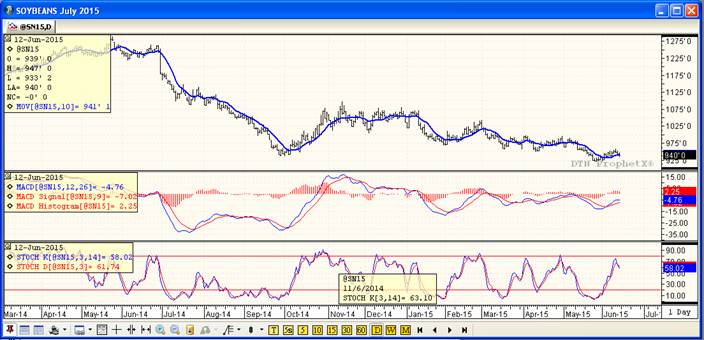

Soybeans:

Not much new news on the bean front. We are still looking for NOPA numbers Monday to be around 147 million bushels vs. 128 last year.

Basis levels in nearby beans were kindda of chatter today as they continue to firm. Processors are enjoying excellent board crush margins and nothing is moving off the farm. This is kindda like a game of chicken – whose going to give first. The trick is going to be locking in good numbers before the flood of old crop bushels to the market.

Technically 2 of 3 indicators remain bearish in both the nearby and the new crop with only the MACD not ready to issue a sell signal. In the nearby, look for support at $9.20 to probably hold for the time being and offer us another technical correction to the higher side, but it’s about time to be ready to get some binned bushels priced. $9.62 and $9.88 would be my target levels. In the new crop we are fast approaching support of $8.96 and I can’t say I’ve got a warm and fuzzy feeling of that holding very well for us for long. Get some orders in to cover bushels at $9.34 and $9.58. You might want to consider cash pricing some of your forward contracted harvest bushel. A big crop usually brings a wider harvest basis.

Wheat:

Are we finding some support in Wheat as we end the week?

Funds were net buyers for the day – probably on weather as it continues to be dry in Canada and wet in the US.

GASC bought 60 tmt from Russia and then retendered for more.

Technically 2 of 3 indicators are now bearish the nearby as we broke through the 10-day moving average at the close. We also closed right-on support of $5.61, so this Monday’s action could very well be pivotal to determining a longer term direction of this market. Anything that can get them to buy back in would be welcome. Get your targets working around $5.85, this is key resistance and way more doable than the $6.05.

In the new crop, we also have 2 of 3 indicators bearish with $5.70 (today’s close) being our near-term support. Shoud we break through the door is open to $5.35 once again. Any bounce would set us up to cover new crop at $5.94.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: