Craig’s Closing Comments

Craig Haugaard

June 16th, 2015

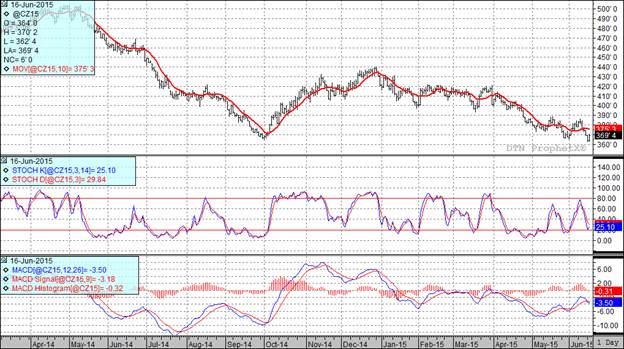

Corn:

Corn was bolstered by the ongoing threat of excessive rain today as traders reacted to yesterday’s crop conditions report. While the current weather conditions will probably have a larger impact on the soybean market they did attract fund buying to the corn pit today.

There is a tendency to focus on threats to production this time of year but we should also make sure that threats to consumption are being considered. One of those threats is the bird flu. By the time it runs its course this year it appears that 50 million birds will have been impacted. If we assume that each bird will eat a bit more than a bushel of corn and then further assume that we will see a slow rate of flock repopulation, it becomes reasonable to suggest that we will see a 100 million bushel decline in feed use from current projections. If all the other demand and supply assumptions remain unchanged this would push the 2014-15 carryout to near two billion bushels and could put more downward pressure on the corn market.

At the present time all three of my technical indicators are bearish both the July and December corn futures.

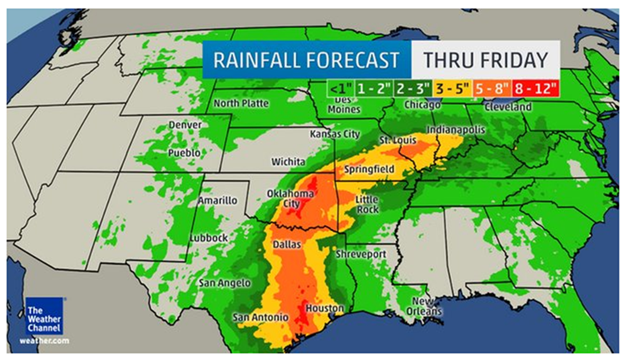

Soybean:

Weather has been a big story this year, although not in the manner that most of us expected a couple of months ago. We have gone from the very real threat of drought to flooded conditions that have kept crops from getting planted in some areas. This delay is most notable in Kansas where only 57% of the projected soybean acres have been planted versus the five year average of 85% and in Missouri where 42% of the bean crop has been planted versus the five year average of 79%. With Tropical Storm Bill making landfall today it is expected to push significant rains back into those areas and may keep up to two million acres of beans from being planted this year. It is the prospect of reduced acres that had traders racing to buy beans today.

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

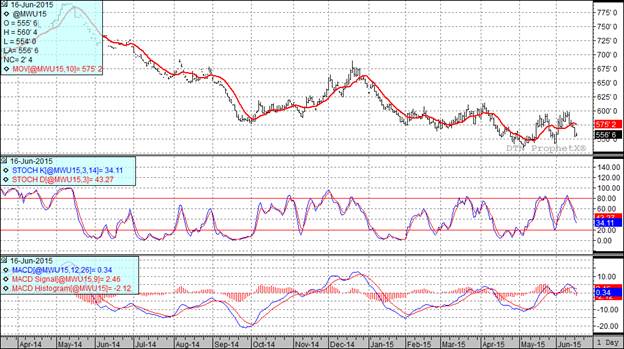

Wheat:

I think wheat is a pretty straight forward story right now. We can talk all we want about delayed harvest in HRW country but at the end of the day we can’t escape the fact that the world has an abundant supply of wheat and we in the USA are just not competitive in the export market. As an illustration of this we need to look no further than the last couple of days. The last couple of days have brought three export tenders for wheat, two of them from Egypt and one from Iraq. Black Sea wheat captured all of the business and it is easy to see why. Russia was offering wheat to Iraq at $231/MT while Canada offered wheat at $266/MT and Australia was offering $267.50/MT. The USA checked in with an offer of $285/MT. That illustrates the gap we have between us and the rest of the world in our wheat prices and as long as that continues we will be basically a non-issue in the export market.

All three of my technical indicators are bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: