Craig’s Closing Comments

Craig Haugaard

June 17th, 2015

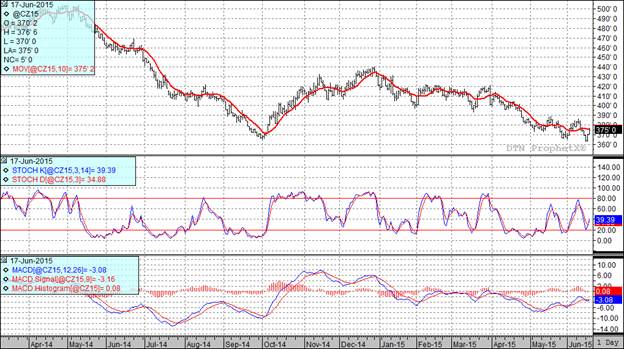

Corn:

The weather continued to set the direction as traders pushed corn higher based on unfavorable weather conditions for parts of the southern Plains and eastern Corn Belt. The conventional wisdom is that we will see a loss in corn acres and reduced production from all the rain in the southern Plains, eastern Corn Belt and Delta.

The only news I saw of note today was the weekly ethanol production report which showed 102.9 million bushels of corn consumed in the production of ethanol last week. We now need to average 99.036 million bushels a week for the rest of the marketing year to hit the USDA’s projected usage number.

We will get the weekly export sales numbers tomorrow and the trade is looking for them to fall into the 450 to 800 TMT range.

Today’s price action swung all three of my indicators into the bull camp for July futures and two of the three into the bull side of the ledger for December corn. I would look for the December corn to run into significant resistance in the $3.80 to $3.90 range.

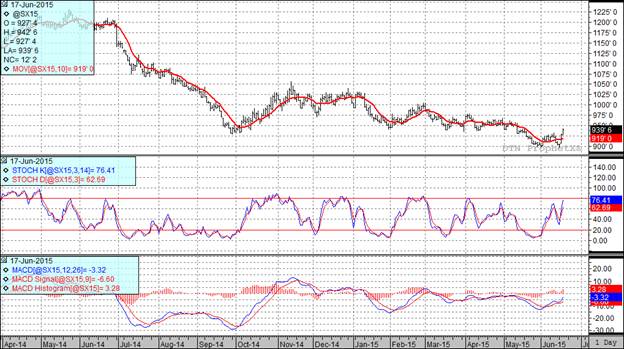

Soybean:

As mentioned yesterday, we traded higher based on the feat that Tropical Storm Bill was going to bring excess rains. That was the case again today as the soybean market traded higher on ideas that there will be a significant amount of soybeans that will not get planted this year. We are still expecting to see additional heavy rains hit the southern Plains area this week from the landfall of Tropical Storm Bill. With only 57% of the beans planted in Kansas and 42% in Missouri another round of heavy rains in those areas may take a chunk of those acres of the table for the year.

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

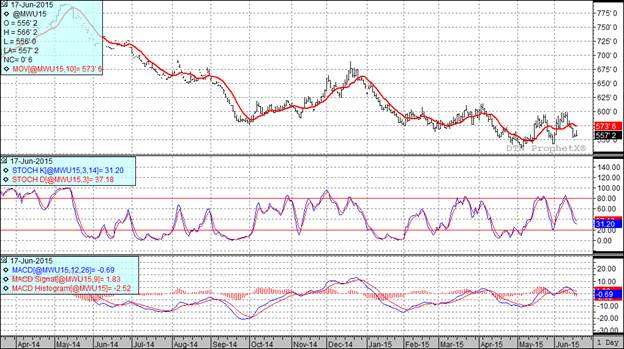

Wheat:

We had wheat higher today as well with crop worries and harvest delays being the impact of these heavy rains in much of winter wheat country. We are still expecting to see heavy rains hit eastern Texas and Oklahoma. Much of the rest of winter wheat country is expected to see a drier pattern develop so perhaps we will the pace of harvest start to pick up. I did talk to accustom combiner today who said he was seeing low test weights as well as low protein. That seems to be in line with what I have read at various chat rooms as well. Hmm, it just occurred to me that my life is pretty sad when I spend time hanging out in chat rooms trying to hear how wheat yields are coming in.

On the international scene we continue to hear of dryness in parts of Russia, Australia and Canada. All of these areas seem to have chances of light showers this week. Finally, I had a long talk yesterday with a man from Ukraine about the conflict with Russia as well as what the crops were looking like over there. In terms of crops he tells me the wheat is looking very good. If true I would continue to see cheap wheat come out of the Black Sea region and kill us in the export markets.

All three of my technical indicators remain bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: