Craig’s Closing Comments

Craig Haugaard

June 19th, 2015

I mentioned earlier in the week that I saw some pretty good crops on my road trip last week-end. Today I received a picture that a friend took of a corn field in Indiana. We have been focusing on the problems caused by heavy rains in portions of the Corn Belt. While we are right to do so we must not lose sight of the fact that many areas are benefiting from the rains. The trade is looking at and evaluating both scenarios and trying to engage in price discovery as a result of that holistic view. I think we would probably all be better marketers if we learned to take the same approach.

Corn:

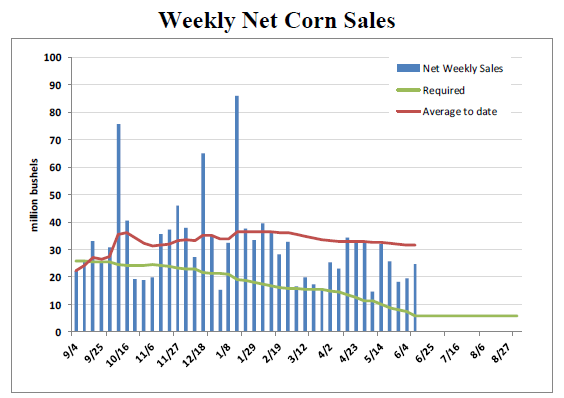

We had pretty sold weekly export sales numbers announced this morning. Coming in at 24.7 million bushels they were slightly above the top end of the range of guesses. That puts export sales at 96% of the annual projection the USDA has been using.

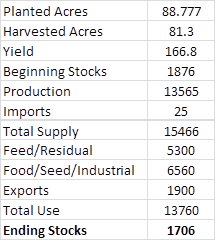

Mid-day today we had Informa release their latest planted acre projections. For corn they are projecting planted acres to come in at 88.777 million acres. That is actually up 40 thousand acres from their May guess but is 422,000 less than the USDA’s current projection. I took the Informa numbers and plugged it into the June 10 USDA report numbers to give you an indication of what the ending stocks would look like if this were to be the actual scenario that plays out.

We will be getting updated planted acres numbers from the USDA on June 30th and the conventional wisdom at this point seems to be that planted acres will be less than what Informa reflected in their report today. Of course, acres are only part of the supply equation, we also need to consider yield. A question the trade has been wrestling with is if negative effects of the heavy rains in portions of the USA outweigh the benefits. At this stage I think the average trader is leaning towards the benefits being larger than the bushels that are being drowned out.

We don’t have a great deal of international news today but I did see that the Chinese government was only able to sell 282 TMT of the corn out of the state reserve. They were offering 5.3 MMT for sale.

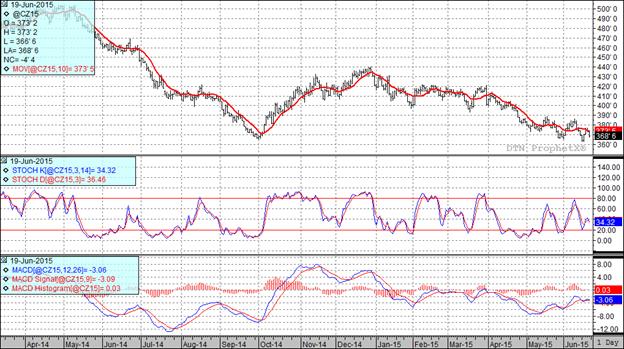

At the present time two of my three technical indicators are bearish both the July and December corn futures.

Soybean:

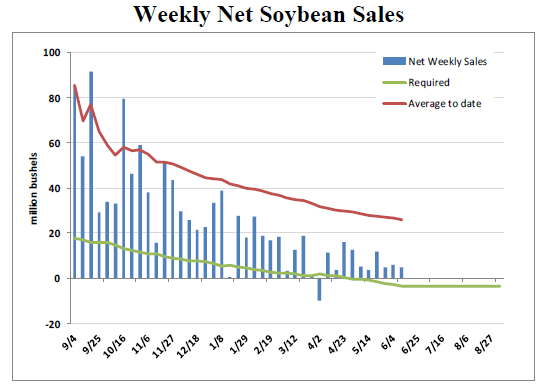

Exports continue to be a big story in the bean market. Weekly export sales once again posted a very solid number, coming in at 4.88 million bushels for the week. That puts cumulative export sales for the year at 102% of the USDA’s projection and means that we will have to average NET CANCELLATIONS of 3.48 million bushels for the remainder of the year to end up at the USDA’s current annual export number. I don’t think I am going too far out on the limb when I say that I expect to see the USDA increase their annual export number.

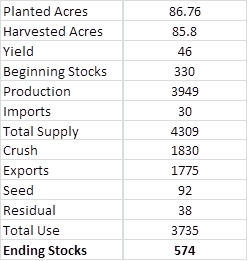

Mid-morning brought the Informa report. They came in with a projection of 86.76 million acres. This was down 425,000 acres from their May estimate but still well above the most recent USDA projection of 84.635 million acres. The following is the June 10 USDA supply and demand chart with today’s Informa planted and harvested acres substituted in place of the USDA’s numbers.

Now obviously, we can play games with numbers all day long but this scenario would tell you that we should be selling new crop soybeans. Of course, we could change the yield to a 42 and we have a totally different game. We have a long way to go in this crop year but these are the things that the folks involved in price discovery are looking at so I want to keep them in front of you as well. Speaking of planted acres, the conventional wisdom is that with the weather becoming more conducive to planting in areas that are lagging we could see a lot of beans go in the ground the next few days.

In international news we have a big crop in South America that just keeps getting bigger. Today Argentina increased their bean crop estimate from 60 MMT to 61 MMT. The latest USDA number is 59.5 MMT.

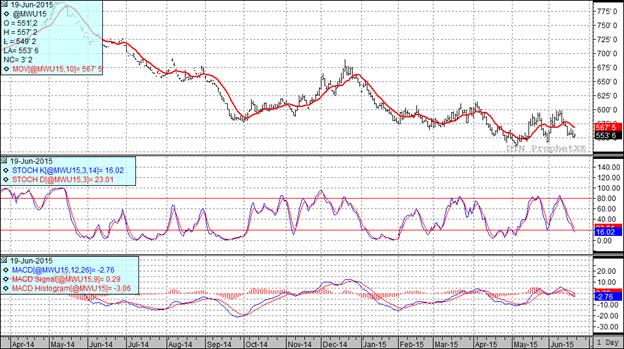

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

Wheat:

Wheat has struggled lately although we did get a better close today. At the end of the day this is a market which is fighting an export market which features lower prices and slow demand. Toss in the approaching USA winter wheat harvest and you have created a tough environment for the bulls.

If the bulls have anything to hang their hopes on it is the heavy rains in HRW country which have delayed harvest and possibly lowering the quality of USA crop. We are also seeing some drought in parts of Canada, EU and Russia although rain is forecast for most of those areas.

The Informa report this morning pegged the 2015 planted wheat acres at 56.2 million acres. That was up a bit from the USDA’s guess of 55.4 million acres. Informa is also estimating the USA production at 2.180 billion bushels, up slightly from the USDA’s recent projection of 2.121 billion bushels. If Informa turns out to be correct that would leave us with a carryout of 885 million bushels.

All three of my technical indicators are bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: