Craig’s Closing Comments

Craig Haugaard

June 25, 2015

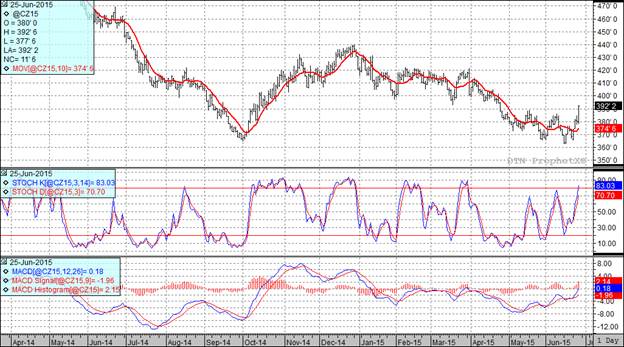

Corn:

Let’s kick the comments off today with stuff nobody cares about, the weekly export sales report. This week it came in at 19.6 million bushels which was below the low end of expectations. With today’s number we are now seeing commitments at 97% of the USDA export number. We shouldn’t have any problem hitting the USDA projection.

We had a good week of new crop sales as they were the 2nd largest of the marketing year.

Of course today that only thing that matter was that concerns over wet weather led to short covering which in turn pushed the market higher. I think we also need to credit the strength in the bean market with an assist in the strength the corn market experienced today.

At the present time all three of my technical indicators are bullish both the July and December corn futures.

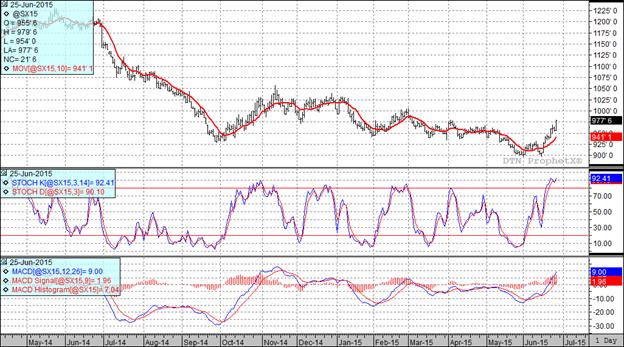

Soybean:

Weekly export sales came in at 4.37 million bushels. This was in line with trade expectations. At this stage of the game old crop commitments are running at 103% of the USDA export figure. We would have to average weekly net cancellations of 4.19 million bushels just to get back to the USDA projection. We will exceed the current number this year. While old crop sales have been great new crop soybean sales are way behind the pace of previous years. The five year average for this point is 9.3 million tons, so we currently are just over 3 million tons shy of the average pace. As if to drive this point home I did hear a rumor that Argentina sold a chunk of beans to China for October delivery which of course is right in the time slot we should be dominating. Along those same lines I am hearing that cheap ocean freight coupled with a soybean meal basis that is plunging in Brazil has Brazilian soybean meal very close to working in the USA.

Of course, none of that matters because for now we are focused on wet weather and prevent plant acres. I don’t think Chuck Norris even has enough courage to short soybean futures right now. With the USDA planted acres number coming out on Tuesday June 30th I would expect this market to stay strong pending that report.

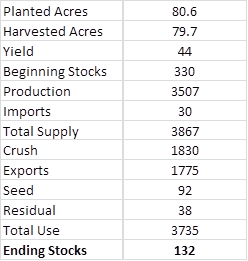

How it goes after that report is anyone’s guess but the following are the two scenarios that I think are most likely. Let’s start off with the bull story. I think it is a given that a bunch of acres are not going to get planted this year. I also think anyone that has spent more than 26 seconds in farm country this year knows that “beans don’t like wet feet” so I assume that the national average yield will be less than the current projection. Just for the heck of it let’s assume that four million acres don’t get planted and that the national average yield comes in 2 bu/acre less than the current projection. If we leave the rest of the USDA numbers unchanged we get the following result:

If this is the scenario that turns out to be the accurate one prices will be higher this fall than they are right now.

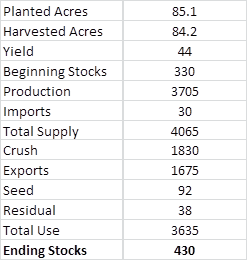

Of course there is also another possibility. Let’s assume that the USDA economists have their heads collectively jammed up their 4th point of contact. We have seen Informa as well as other private analysts suggest that the actual planted acres were going to be 2 or 3 million more than what the USDA is projecting. In spite of today’s strong move higher I am hearing a few whispers that we could actually see acres up a half million from the USDA’s current projection. Let’s take that, knock the yield down to 44 and then slash 100 million bushels out of export demand as a result of the high dollar and the record South American crop looking for a home. As reported above, we are already falling well behind the historic pace so this is a very real possibility. In this case we end up with a 430 million bushel carryout and trade a dollar lower than we are today.

So, at the end of the day I think we can make the case that the carryout will fall between 100 and 500 million bushels and that the November price will trade in the $8.50 to $12.00 range. That astute analysis should win me the Nobel Prize in economics and also illustrates that we are probably still facing a lot of market volatility in the coming days.

At the present time all three of my technical indicators are bullish both the July and November soybean futures.

Wheat:

Weather was in the story in the wheat market as well. Here in the good old USA the wheat market moved higher as fears that rain will damage a winter wheat crop that is ready to harvest led to short covering. We had the opposite fears coming out of Europe where fears of reduced yield as a result of drought also added strength to our markets today.

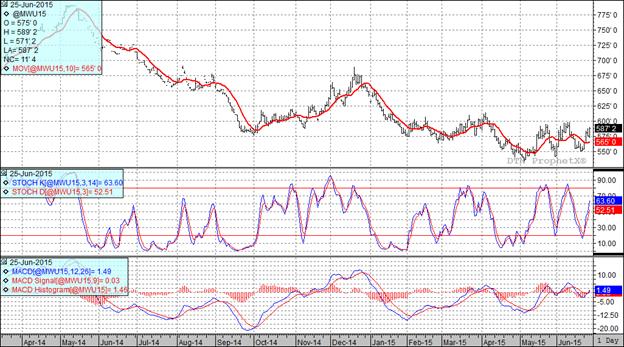

All three of my technical indicators are bullish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: