Craig’s Closing Comments

Craig Haugaard

July 1, 2015

After the excitement of yesterday, today was filled with profit taking. Wheat was the biggest loser as it gave back the majority of yesterday’s gains. Soybeans also surrendered some back with corn able to surge late and post another positive close. At the end of the day this was probably nothing more than a little profit taking as the trade had time to ponder yesterday’s numbers and took a little spending money off the table heading into the long week-end. After everyone gets back from the long week-end I suspect the trade will refocus on crop conditions and weather forecasts. This will probably mean some post 4th of July fireworks.

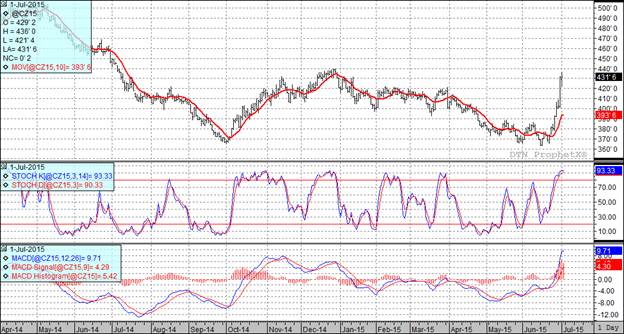

Corn:

We really didn’t have much news to trade today. Farmer grain sales have been strong across the entire Corn Belt which is leading to some weaker basis numbers.

On the demand side of things, today’s weekly ethanol report indicated that 101.64 million bushels of corn were used in the creation of ethanol last week. This makes seven weeks in a row that has been above 100 million bushels and leaves us needing to average 98.274 million bushels per week for the remainder of the marketing year to achieve the USDA’s projection.

The noon weather maps increased chance for rains next week which helped generate the late rally in the corn pit.

At the present time all three of my technical indicators are bullish both the September and December corn futures.

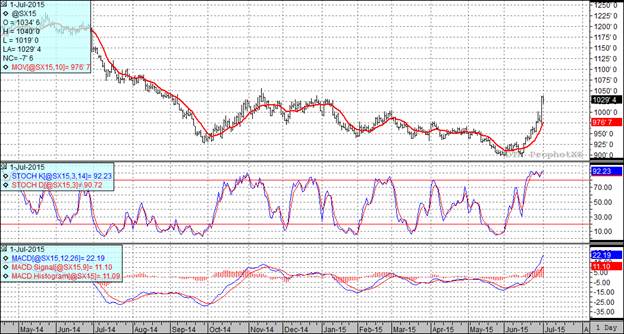

Soybean:

With the strong day we experienced yesterday it was probably not a surprise to see the market back track slightly today.

As I mentioned above, the Eastern Corn Belt has a lower chance to rain as we head into the week-end which would certainly be welcomed by them. On the other hand some rain is still in the forecast and if that turns out to be more substantial than expected Monday could be a runaway again. I think we are going to be living and dying with each fresh weather report for the next month or two.

I think I covered this yesterday but it is still with noting that the soybean acreage which is going to be resurveyed will be updated in the August 12th Crop Production report. Between now and then we are going to keep the private analysts and traders busy guessing.

At the present time all three of my technical indicators are bullish both the September and November soybean futures.

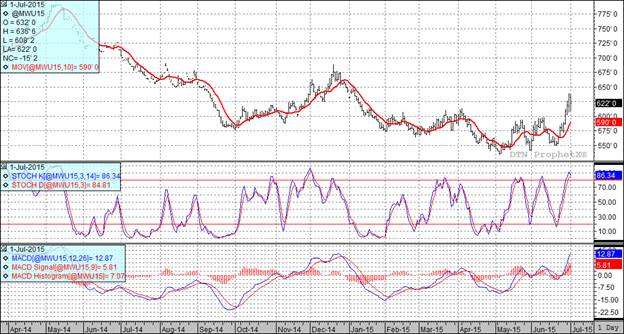

Wheat:

In yesterday’s report the USDA increased the planted acres and gave us a quarterly stocks number that was above the top end of the range of trade guesses. Not exactly the recipe for a rally but wheat was caught up in the excitement and pulled higher by the other markets. Without those coattails to ride and with a sharply stronger dollar to boot we saw wheat give up most of yesterday’s gain today.

At the end of the day the wheat fundamentals are bearish but I expect them to follow the general direction of corn.

In spite of bearish fundamentals not all is sunshine and roses. The wheat crop still faces too much rain in places like Missouri, Illinois, Indiana, and Ohio. On the other hand we see drought stress in the northwestern USA states, Canada, Germany, and France.

In spite of the lower close all three of my technical indicators are still bullish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: