Craig’s Closing Comments

Craig Haugaard

July 2, 2015

As we enjoy our various 4th of July festivities this week-end I hope we take time to reflect on the great gift that our founding fathers have given us. The final sentence of the Declaration of Independence is a promise among the signers, to “mutually pledge to each other our Lives, our Fortunes, and our Sacred Honor.” It was no slam dunk that we were going to win our freedom and many of the founding fathers suffered great personal loss in seeking to establish it. They knew that once established there was no guarantee that it would be preserved. As Benjamin Franklin said, ‘We have given you a democratic-republic… if you can keep it.” Would be that we are as diligent in protecting it as the founding fathers were in providing it. Have a great 4th everyone.

Corn:

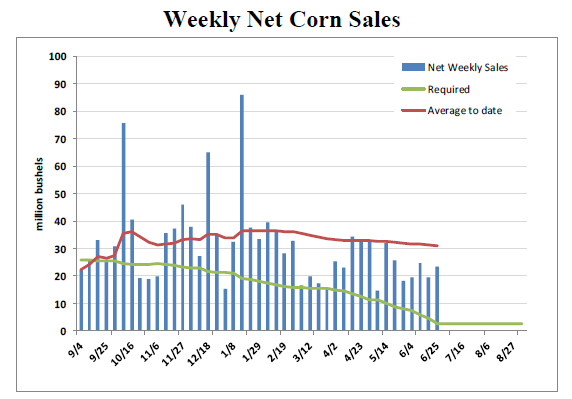

We had a fair amount of export type news today. Starting out in the USA we had weekly export sales announced at a very solid 23.4 million bushels. That means that we now have export sales on the books that are equivalent to 99% of the bushels the USDA is projecting we will export this marketing year.

The export news was not limited to domestic news as we received a report from Ukraine that for the 2014-15 crop year they exported a record 34.6 MMT of grain, up 4.7% year-over-year. Of that total 18.9 MMT of it was corn. Looking forward the Ukrainian agriculture minister estimates 2015-16 exports will fall in the 34 to 37 MMT range.

I also saw a report from China’s National Grain and Oils Information Center in which they estimated that China may only import 4 MMT of DDG’s in 2014-15. This is 0.5MMT less than their last estimate and down 2.65 MMT from last year’s imports.

We had some fresh numbers from Informa out today as they took a stab at projecting 2015 harvested acres, national average yield and total production. They are putting harvested acres at 81.101 million acres with a national average yield of 165.4 bu/acre. This combines to give a total production number of a projected 13.412 billion bushels. In Informa’s last estimate they were pegging total production at 13.0564 billion while the most recent USDA projection was 13.63 billion bushels.

While the domestic numbers have gotten the majority of the attention Informa did also release some updated estimates on the Brazilian corn crop. They increased the projected size of the 2015 crop from 76 MMT in their last report to 78 MMT in today’s report. They also bumped the size of the 2014 crop by 1.8 MMT, up to a production number of 82 MMT.

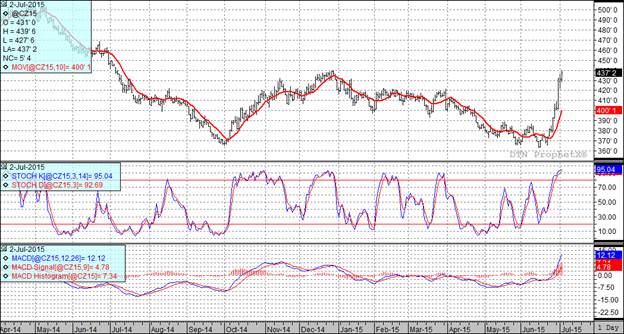

At the present time all three of my technical indicators are bullish both the September and December corn futures.

Soybean:

The weekly export sales came in at a negative 380,000 bushels with cancellations from China and “unknown” which is also probably China. This was only the second time this marketing year that we have had negative sales but in spite of this week’s performance old crop bean sales are still chugging along at 103% of the USDA’s projection. Probably the bigger concern is new crop sales where were running roughly 36% behind the five year average.

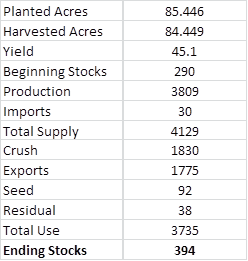

The Informa numbers today showed that they are now expecting harvested acres to come in at 84.449 million acres. They are currently projecting the national average yield to come in at 45.1 bu/acre which would yield a total production number of 3.808 billion bushels. If we take the implied reduction in stocks that we saw in the USDA report earlier this week and then plug in these Informa numbers we get the following S & D table.

Informa’s South American numbers moved bean production in Argentina up to 60.5 MMT an increase of 0.5 MMT over their previous report. At the same time they adjusted the projected 2015 bean crop in Brazil down by 0.5 MMT to a total of 97 MMT.

We did see some news coming out of Europe which may be supportive to the oilseed market. According to reports it appears that the 2015 EU rapeseed crop is likely to drop to 21.8 MMT, a decrease from last year’s 24.6 MMT crop. This reduction is the end result of dryness and insect damage that has impacted crops in several countries including France and Germany.

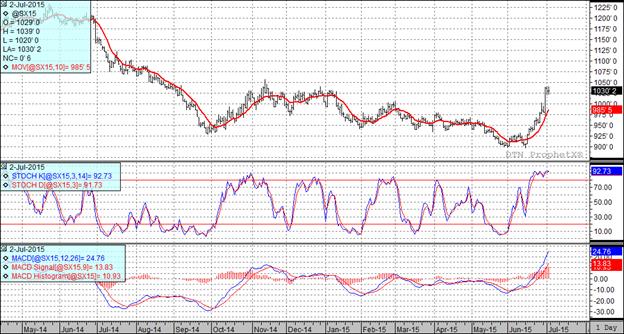

At the present time all three of my technical indicators are bullish both the September and November soybean futures.

Wheat:

Weekly USA wheat sales came in at 13.4 million bushels. It is early in the marketing year but thus far total export commitments are at 214.8 million bushels versus 288 million bushels on the books last year at this point. The USDA is projecting annual exports of 925 million bushels, up from 855 million last year. He’s not the sharpest knife in the drawer but even my slow cousin Jimmy could tell you that lagging wheat sales is not going to magically result in a year over year increase so we are going to need to see the pace of exports pick up here or revise the annual projection downward.

Today’s Informa analysis pegged the USA wheat crop at 2.162 billion bushels. This was down from their previous projection of 2.179 billion bushels but up from the recent USDA projection of 2.121 billion bushels.

In spite of a lack of any real bullish news we were able to close fairly solidly as we saw short covering ahead of the long week-end.

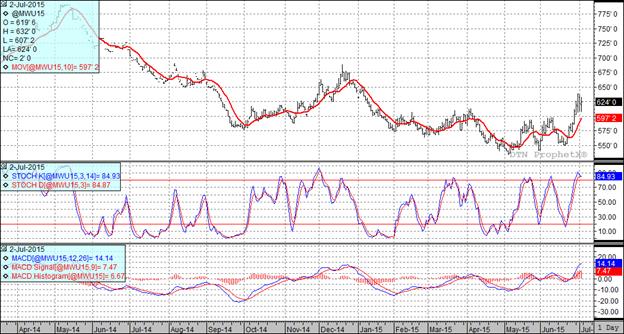

At the present time all three of my technical indicators are still bullish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: