Craig’s Closing Comments

Craig Haugaard

July 6, 2015

It is the end of an era today as the open outcry futures trading pits are now officially closed. I first visited the Chicago Board of Trade in 1977 and was captivated by the energy of the pits. The following pictures are of a trading pit in its glory days and the second picture is o the soybean pit earlier today. On a side note a couple of weeks ago I had the opportunity to be on the floor for the World Cup of Futures Trading awards ceremony. It was the last official event hosted by the Chicago Mercantile Exchange prior to the closing of the open outcry pits so I suppose being a part of that gives me some small footnote in CME history.

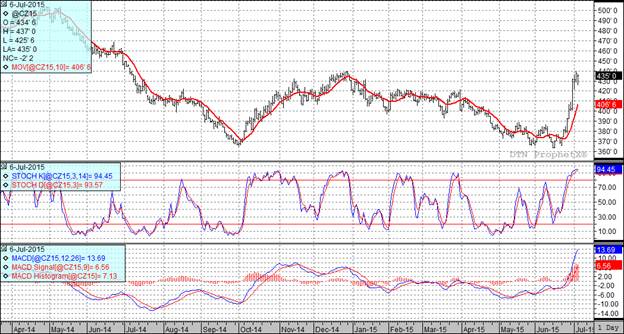

Corn:

We had a mix of weather and outside factors that drove this market today. Generally good weather over the week-end coupled with a forecast that looks more favorable this week for crop development with less rain and cool temperatures put pressure on prices. Also pressuring prices were the reaction to Greece’s financial default and China’s emergency move to plug their stock market plunge. This initially led to a stronger dollar in the overnight trade but it slipped as the day trade wore on.

We kicked off the morning session with the weekly export inspections. They checked in at 33 million bushels, at the low end of expectations. Additional export related news came out of China where the rumor in the trade is that China’s crush margins are in the red, they are canceling DDG’s, and talking about increasing subsidies to get their reserve corn sold.

After the close we had the weekly crop conditions report. The trade was looking for perhaps a little more slippage with a best case scenario that the condition would remain unchanged from last week so I suspect there were some surprised folks when conditions were reported at 69% good to excellent, up 1% from last week’s 68% good to excellent rating.

At the present time all three of my technical indicators are bullish both the September and December corn futures.

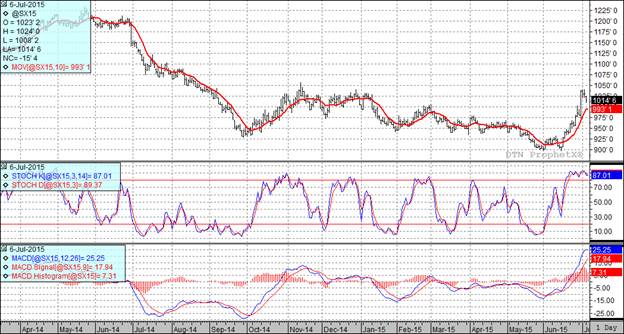

Soybean:

The good weather outlook exerted significant pressure on the bean market today. Once you get past the weather there was very little to talk about.

The weekly export inspection number came in at 7.3 million bushels which was right in line with what the trade was expecting.

After the market closed we had the weekly crop conditions report which left soybeans unchanged for the week at 63% good to excellent. The trade was looking for a small decline. Perhaps the most important news in the report was that soybean planting now stands at 96% complete. Missouri continues to lag by the greatest amount with only 73% of the crop planted versus the five year average of 97% planted. If we assume that the USDA was correct with their projection of 85.139 million planted acres that means that as we stand right now we have 3.4 million acres left to be planted. I have to believe that acres planted at this point in the year are not going to yield up to their potential.

As it stands right now I think this market is a tug of war between the bulls who would point to the expectation of reduced acres and yield coupled with a reduction in the size of the 2014-15 carryout versus the bears who will tout a weather pattern that seems to be returning to normal coupled with a record South American carry-out as a reason to be bearish. Should be interesting to see how it plays out.

At the present time two of my three technical indicators are bullish both the September and November soybean futures.

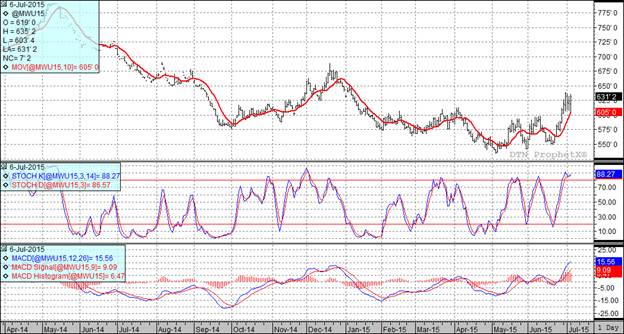

Wheat:

After getting slammed in the overnight we saw wheat stage a comeback as worries over adverse weather around the world carried the day. The heat wave in Europe and dryness in Canada in particular had the bears on the ropes.

We had pretty decent weekly export inspections this morning. They came in at 13.6 million bushels which was at the upper end of the range of trade estimates.

This afternoon’s crop conditions report had winter wheat conditions falling 1% to 40% good to excellent. It also appears that after a slow start we are starting to make good harvest progress. The winter wheat crop is reportedly 55% harvested versus the five year average of 59% percent.

We saw the spring wheat condition retreat 2% to 70% good to excellent. The crop is reportedly 76% headed, well ahead of the five year average of 47%.

At the present time all three of my technical indicators are still bullish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: