Craig’s Closing Comments

Craig Haugaard

July 7, 201

Yesterday marked the start of the Running of the Bulls Festival in Pamplona. It is a nine day festival so if you really feel the need to run with bulls in Spain you still have time to book a flight and get on over for the fun. It will be interesting to see if the commodity bulls run along with the Spanish bulls the next couple of weeks.

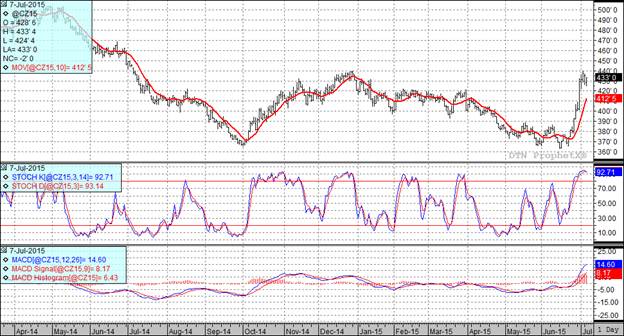

Corn:

We had kind of an interesting day in the market today. We came under a great deal of pressure right out of the chute as the dollar was sharply higher while the situation in Greece remains a mess and the Chinese stock market continues to fall apart. The six to ten day forecast also looks drier normal to below normal temperatures and this was seen as bearish.

As the session wore on we received the estimates for Friday’s USDA report which indicated that the trade is looking for old crop stocks to come in at 1.814 billion bushels, down from the June estimate of 1.876 billion. Traders are pegging the new crop carryout at 1.549 billion bushels, down from 1.771 billion in June. World ending stocks are estimated to decrease as well with the trade projecting number of 195.09 MMT versus 197.01 MMT in the June report.

On the international front we have Safras reporting an increase to the Brazilian corn crop of 3.3 MMT pegging the crop at 85.6, up from their last estimate of 82.3 MMT and a sharp increase from the USDA’s 81 MMT.

At the present time two of my three technical indicators are bullish both the September and December corn futures.

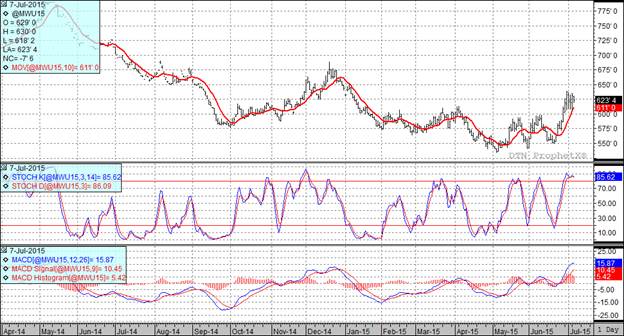

Soybean:

Good weather and a strong dollar pressured beans from the opening bell today. We closed below the $10 level in November beans which is kind of a significant psychological barrier.

Heading into the July 10th USDA report the trade guesses are all over the board. We have some traders feeling that the USDA could drop the supply enough to push USA 2015-16 soybean carryout below 200 million bushels versus the most recent USDA June estimate of 475 million bushels. The average guess for the USA 2015-16 soybean carryout is near 380 million bushels with a range from 193-460. If we did end up at 193 million bushels it could mean 12.00 soybean futures while conversely a 460 million bushel carryout could mean 8.50 futures.

On the international front the Brazilian real was weaker versus the USA dollar which is giving Brazilian soybeans a competitive advantage over USA beans.

At the present time two of my three technical indicators are bearish both the September and November soybean futures.

Wheat:

On the domestic front improving weather and an increased harvest pace for winter wheat put pressure on the market today. Heading into Friday’s report the trade is looking all wheat production to come in at 2.145 billion bushels with all wheat carryout at 860 million bushels.

On the international front we are seeing an interesting story in Russia where wheat exports are at a virtual standstill while the government and traders try to figure out their wheat export tax.

In Ukraine the wheat harvest is now forecast at 24 MMT, up from USDA’s current 23 MMT projection.

We are seeing the potential for some export business with Egypt’s GASC is tendering for 55 TMT of USA SRW wheat, USA white, Ukrainian, Russian and/or Australian white wheat, as well as 60 TMT of soft and/or milling from other origins for mid-August shipment. It will be interesting to see who gets the business.

At the present time two of my three technical indicators are still bullish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: