Closing Comments

Lynn Miller

July 8, 201

Some general influences on the market place:

Negative: the ongoing financial crisis in Greece, the stock market plunge in China

Positive: Rain, rain go away in Indiana, a weaker dollar and pre-report positioning.

Friday – Monthly USDA WASD report (Supply & Demand)

Corn:

Corn rallied today after two days of lower closes as the market starts to even positions coming into the Monthly USDA report Friday with funds believed to have bought 3,000 contracts today.

Export sales numbers tomorrow. Market guesses right now range from 400-600 tmt old crop and 200-350 tmt in the new crop.

Ethanol production was up 19,000 barrels for the week putting production at 987,000 barrels per day. However, stocks are also up 300,000 barrels on the week to put total stocks at 19.8 million barrels.

Technically, New Crop corn is shaping up into something to watch. I say that as we consolidate here just below the gap we put in one year ago yesterday. The MACD and Moving Average are still bullish; however, the stochastics are issuing a sell signal in overbought territory. Look for support in the December at $4.17 with resistance at 4.34 (today’s close), the 4.44 gap which may very well trigger some technical sell off when it fills and $4.50 above that. These price levels would all be good places to put some sales on.

As for the nearby corn, look for support to hold at $4.13 for now with resistance at $4.32 and $4.50. Basis continues to sneak wider on us as farm bushels start to move.

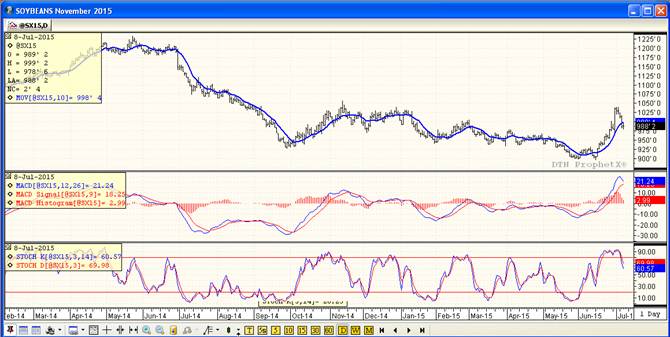

Soybeans:

Right out of the shoot this morning we had a USDA announcement of 240 tmt of US beans for 15/16. We followed that up with Informa’s recent bean numbers. They are predicting Missouri will be 1 million acres lower due to wet conditions. The result is a lost 41 million bushels.

Export sales numbers are out tomorrow. Current trade guess ranges from 40 to +200 in old crop beans and 100-300 in the new crop.

We hear Brazilian crush margins are shrinking and that there is talk of plant slowdowns there.

USDA report will be out Friday. Trade is looking for a smaller carryout. But some caution will probably be seen as the resurvey numbers for acres are not set to be released until the August report.

Technically 2 or 3 indicators are now bearish both old and new crop beans. In both months yesterday’s price action dropped below the moving average and the stochastics are in sell mode in neutral territory. The MACD remains bullish. Look for support in the Nearby at 9.81 with target levels of $10.03, 10.24 and 10.94 if you are really optimistic. In the NC, I’m hoping support of $9.77 will hold for the time being. I would be looking to cover bushels for this harvest on any rallies from here on out. My target levels being $9.96 and $10.58 (this is a level we haven’t seen since August of 2014).

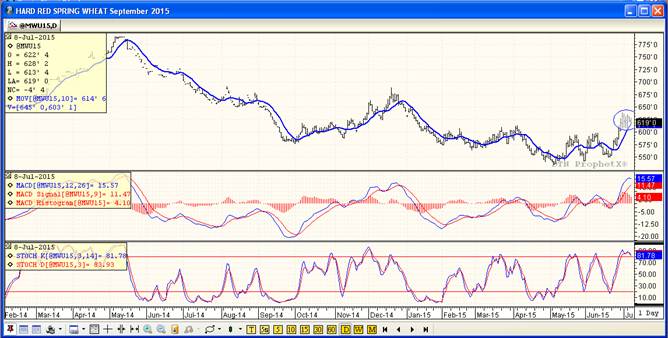

Wheat:

We were hearing talk today that the cheapest offers in the GASC tender were around $202/tom vs US Gulf wheat offered at $250/ton. The US continues to be uncompetitve in the world market place - the world has a lot of wheat.

Export sales tomorrow are forecast to be between 300 – 500 tmt.

Traders will focus on ending stocks in Friday’s report. Reuter’s estimates new 15/16 ending stocks at 861 million vs. 814 in June. World stocks; however, are forecast to shrink a little.

Technically 2 of 3 indicators remain bullish the September Spring Wheat futures with only the Stochastics issuing a sell signal. At the present we see support at $6.11 with resistance at $6.29 and a lofty goal of $6.89. The price action of the past few days may very well be the formation of a bull flag in the works. I am not real versed at the reliability of this type of formation, but if there is momentum building we could see this break out to the upside.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: