Closing Comments

Lynn Miller

July 9, 2015

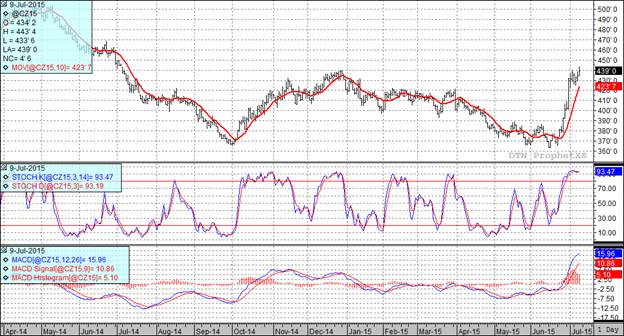

Corn:

We had a pretty nervous market heading into tomorrow’s USDA Crop Production and Supply & Demand reports. Heading into that report the average trade guess is that we will see the USDA take the 2014-15 carry-out to 1.811 billion bushels, down 65 million from last month. For the 2015-16 production number the trade is expecting to see 13.44 billion bushels of production which will yield a 2015-16 carryout of 1.54 billion bushels. That is a fairly significant, 231 million bushels, decrease from the June report. The trade is looking for the world carryout to tighten up slightly as well with the average trader looking for the 2015-16 carryout to move from the 195.19 MMT projected last month to a guess of 192.96 MMT heading into tomorrow’s report. While most of the attention tomorrow will be on the USA story we need to keep an eye on South America as well. Conab raised their Brazilian crop estimates again as they now have this year’s corn crop pegged at 81.8 MMT, up from their last estimate of 80.2 MMT and also stronger than the last USDA guess which came in at 81.0 MMT. Their double cropped (Safrinha) corn was increased from 49.4 to 51.6 MMT.

Weekly export sales were announced today and they were a fairly solid 21.1 million bushels. That pushes year to date commitments to 1.819 billion bushels so if I am doing my math correctly this means we only need export 6 million more bushels this year to achieve the USDA projection. We should bypass that level next week. In spite of our strong exports I find it interesting that a boat of corn out of Brazil was loaded for the USA East Coast this week, with reportedly a couple more bought for fall delivery.

At the present time all three of my technical indicators are bullish both the September and December corn futures.

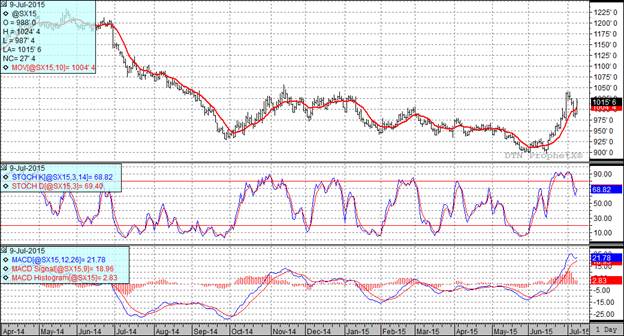

Soybean:

The soybean market was moving faster than greased lightning today as the market surged on weather concerns as well as expectations over tomorrow’s report. The eastern Corn Belt saw more rain last night with an area about 100 miles south of Chicago picking up four inches of unneeded precipitation.

The trade is clearly expecting bullish numbers tomorrow with the 2014-15 carryout adjust downward from 330 million bushels last month to 287 million in tomorrow’s report. The trade is looking for the projected production number move from 3.85 billion bushels last month to 3.776 billion in this report. If we couple the reduced 2014-15 carryout with the decreased yield one would expect to see the 2015-16 carryout reduced as well and that is exactly what the trade is projecting as they see it moving from 475 million bushels in the June report to 370 million in tomorrow’s version of the report. They are also looking for the 2015-16 world carryout to slump slightly as they see it moving from 93.22 MMT in June to 91.84 MMT this month.

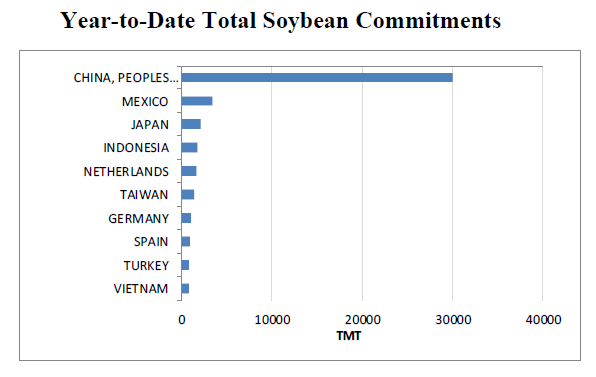

The weekly export sales report gave us sales of 1.52 million bushels. Not great but certainly an improvement from last week’s net cancellations. This put total export commitments for the year at 1.857 billion bushels and also means that we need to see weekly cancellations of 5.25 million bushels per week for the remainder of the marketing year in order to get back the USDA’s export projection number. Don’t be surprised if they increase that estimate in tomorrow’s report. While that is all good news I am concerned about the pace of exports thus far for the 2015-16 marketing year as new crop bean sales continue to run well behind last year. This year’s 2015-16 commitments are 233.1 million bushels versus 430.7 million on the books last year at this time. With South America still getting sales in the fall time slots that we usually dominate we will want to keep an eye on this situation. China has been in the news a great deal the past couple of days as their stock market has struggled. Hopefully their economy will be OK because, as you can see on the following chart, we rely on them very heavily as a soybean market.

At the present time two of my three technical indicators are bullish both the September and November soybean futures.

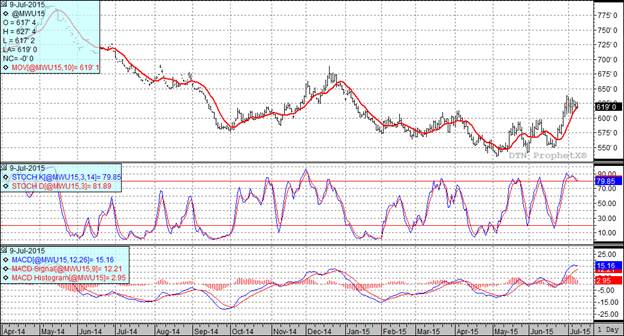

Wheat:

The weekly export sales numbers for wheat came in at 12.7 million bushels which was at the bottom end of the range of trade guesses. We have a lot of the wheat marketing year left and at this point will need to average sales of 14.53 million bushels per week to hit the USDA’s annual export sales projection. In my comments on Tuesday I mentioned that Egypt was in tendering for wheat. The feedback that I am getting is that we ended up being as much as $50/MT too high to get the business.

Heading into tomorrow’s report the trade is not expecting any surprises in the wheat story. The average trade guess has total wheat production up 27 million bushels from last month’s report. On the carryout side of things the trade is looking for the carryout to increase by 47 million bushels to a total of 861 million bushels. On the world stage no big shifts are expected either with the trade anticipating a slight reduction in carryout, moving from 202.4 MMT last month to a projected 200.41 MMT tomorrow.

With today’s action two of my three technical indicators are now bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: