Craig’s Closing Comments

Craig Haugaard

July 10, 2015

Corn:

Today was all about the USDA’s July Crop Production and Supply & Demand report. The old saying is that the early bird gets the worm but that was not the case with today’s report. As you can see on the following 5 minute bar chart we had a sharp drop in prices right at 11 a.m. when the report came out and the traders read the initial numbers. Then they got to page 2 and probably thought, “Oh, crap, this isn’t bearish” and started buying. Of, course this could also all be a figment of my imagination but it was an interesting swing in price in a short time.

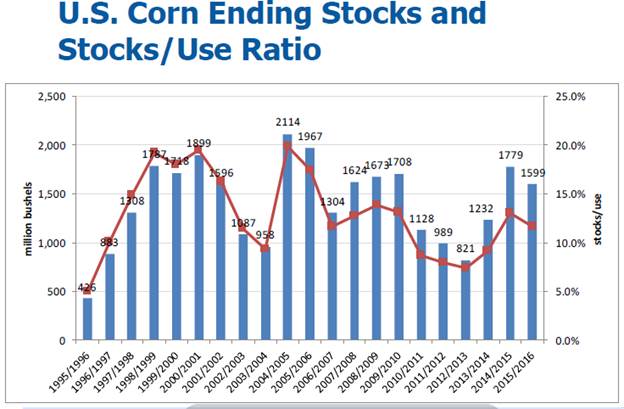

The numbers themselves were a little mixed. The trade was expecting the 2014-15 carryout to come in at 1.811 billion bushels so today’s actual number of 1.779 billion was friendly. On the other hand the trade expected to see the national average yield projection for 2015-16 to slip from 166.8 bu/acre last month to 165.391 bu/acre this month while also expecting the carryout to fall to 1.54 billion bushels. In reality the USDA left the projected national yield unchanged at 166.8 and pegged the carryout at 1.559 billion bushels. When it comes to the national average yield the average trader seems to believe that the USDA has their head firmly up their fourth point of contact.

At the present time all three of my technical indicators are bullish both the September and December corn futures. We filled the gap in the December futures at $4.46 ½ so it will now be interesting to see if we backtrack or if we can keep this upward momentum.

Soybean:

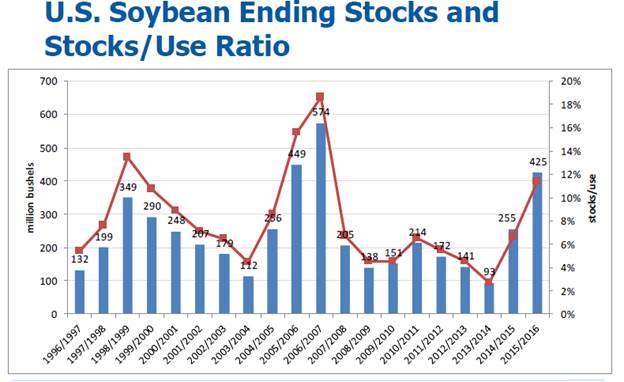

Beans provided some big swings in the first few minutes after the report as well. The trade was expecting to see the 2014-15 ending stocks to come out at 287 million bushels but were given a more bullish carryout of 255 million bushels. For 2015-16 the expected reduction in national average yield didn’t develop as the USDA left it unchanged at 46 bu/acre. We also didn’t get as large a reduction in the 2015-16 carryout as the trade was looking for. They had anticipated a carryout of 370 million bushels with today’s number coming in at 425 million. If we take this at face value it would appear that we will have an ample supply of soybeans.

At the present time all three of my technical indicators are bullish both the September and November soybean futures. If the following stocks to use ratio turns out to be accurate we may be close to the top of this market. I think, however, we have a lot of weather to get through before we determine that.

Wheat:

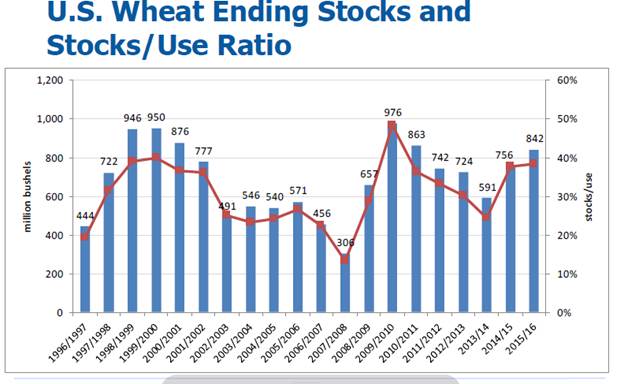

Domestic ending stocks for 2015-16 moved up from a projected 814 million bushels in the June report to 842 million in today’s report. We saw the same trend in the global ending stocks as they moved form 202.4 MMT in June to 219.81 MMT in today’s report. I look for wheat to continue to be the weak link in the grain market but if corn continues to move higher perhaps we will see that help support wheat.

With today’s action two of my three technical indicators are now bearish both the Minneapolis and Kansas City September futures. As you can see on the following chart, we have a more than ample supply of wheat.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: