Craig's Closing Comments

Craig Haugaard

July 14, 2015

Just in case it may have slipped your mind, today is Cow Appreciation Day. If I am not mistaken Cow Appreciation Day was started by Chick-fil-A in a 1995 ad campaign in which cows encouraged consumption of red meat. Other ag organizations have picked up on it and I believe that Chick-fil-A customers who dress as cows will receive a free meal at Chick-fil-A. I will be honoring bovines in my own way with a nice ribeye on the grill as I appreciate this magnificent creature.

Corn:

The stage for today’s performance was probably set yesterday when the crop condition report showed unchanged conditions versus trade expectations for a small decline. That surprise was followed today by an improving extended weather forecast with temperatures expected to be normal to above normal and precipitation projected to be normal to below normal for the next couple of weeks. Conventional wisdom is that this may allow some of the crop to recover from the extreme wet conditions experienced in portions of the Corn Belt.

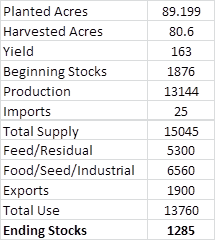

Private analysts are still busy projecting where they think this crop is going to settle out. Today we had Dr. Cordonnier take a shot at it. He left his corn yield unchanged this week at 163 bu/acre while also projecting total production at 13.14 billion bushels, but also indicated that he believes the yield is trending lower. The following table uses his yield and then I tweaked the harvested acres number to arrive at his total production number. All other numbers are left unchanged from the recent USDA report. As you can see, under this scenario the carryout drops to less than 1.3 billion bushels.

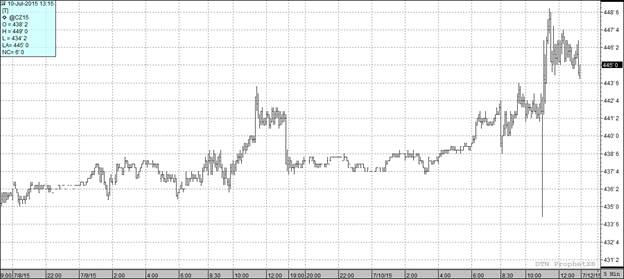

At the present time two of my three technical indicators are bullish both the September and December corn futures. What I find interesting is that we posted a key reversal down today and settled just above the 10 day moving average. Generally, when you have a key reversal you get some follow through in that direction. In this case that would be lower. We have Fibonacci support points at roughly $4.33 and $4.20. I suspect if we see this market get down into the $4.20 level we will pick up a bunch of buying.

Soybean:

Bean prices hung in there tougher than the corn prices did but at the end of the day the warmer and dryer weather forecasts for the southern and eastern growing regions coupled with better rain chances in the upper Midwest where the beans are already looking good pressed the market lower.

Crop progress is about where it should be with the latest crop conditions and progress reports showing that 38% of soybeans have bloomed versus the five year average of 37%. It was also reported that 6% of the beans are setting pods versus the five year average of 7%.

Where we continue to lag is in planted acres with Missouri still continuing to struggle. They are now reporting that 80% of their beans are planted. That is up 7% from last week but still leaves 1.2 million acres left to plant. Illinois is doing better at 96% planted, but that still leaves about 400,000 acres left to plant.

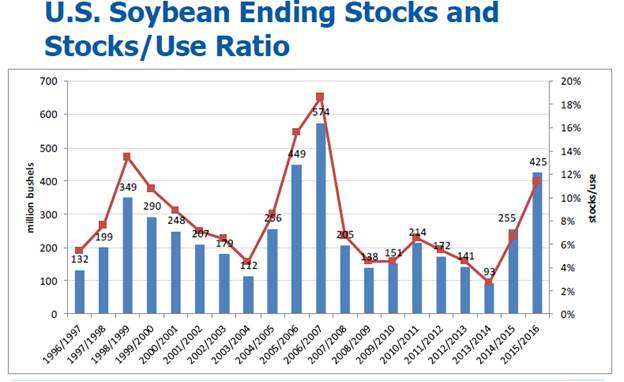

Dr. Cordonnier, in his latest report, kept his soybean yield unchanged at 43.5 bu/acre with production of 3.58 billion bushels. He also indicated that his bias is that we will see the projected yield decline as this crop moves forward. The following table uses his national average yield and then tweaks the harvested acres number to hit his total production numbers while leaving the rest of the USDA numbers unchanged.

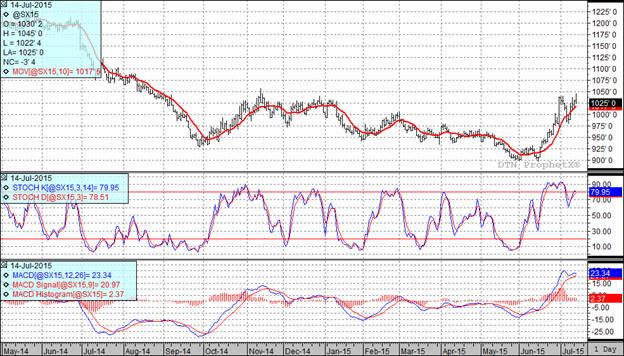

In spite of a softer close today all three of my technical indicators are still bullish both the September and November soybean futures.

Wheat:

As far as I can tell the story here continues to be our lack of competitiveness in the export market. Egypt bought wheat from Russia and Romania while the USA missed out on business in the most recent tender. The disparity in world price structure was probably most driven home to me when I heard that French wheat is very close to working into Albany, NY.

While we are getting kicked around in the export market here at home harvest is moving along with winter wheat now 65% harvested. On a more local note we received our first sample of winter wheat late yesterday and the quality looked pretty good. With harvest progressing the USA has also seen steady farmer selling which in turn has led to lower cash markets as we see supplies increasing.

At the end of the day we have ample world supplies of wheat, the USA is overpriced and that combination brought in fund selling again today. Really not to complicated.

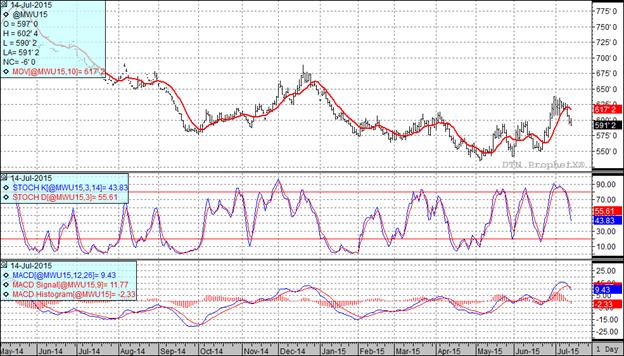

At the present time all three of my technical indicators are now bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: