Craig's Closing Comments

Craig Haugaard

July 16, 2015

Seventy years ago today the work of the Manhattan Project culminated in the detonation of the world's first atomic bomb at the Trinity Test Site at Alamogordo, New Mexico.

Corn:

Weather is still a dominant market driver. In the overnight the prices traded higher based on rain showers in Iowa that were expected to move east, however, the 6-10 day maps predict average temperatures for the entire Corn Belt with average to below average rain for the West and below average rain for the East.

The weekly export sales numbers were out today and were not nearly as robust as we have seen in recent weeks. In fact, it was the lowest weekly export sales number we have seen this marketing year. We came in at 13 million bushels which was right at the low end of the range of trade guesses. For the year that puts cumulative exports commitments at 1.832 billion bushels versus the USDA’s projection that we will export 1.85 billion bushels for the year. A decent week next week could propel us past the USDA projection.

At the present time two of my three technical indicators are bullish both the September and December corn futures.

Soybean:

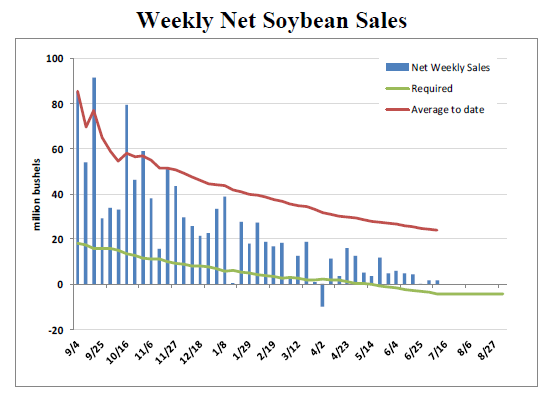

The weekly export sales were not runaway, but at 1.67 million bushels they were positive and leave us in a position where we have export commitments totally roughly 102% of what the USDA’s annual export projection is. At this stage of the game we will need to average net cancellations of 4.24 million bushels per week to get to the USDA’s projected number. While old crop exports have been going well there remains concern over the pace of new crop sales. This week brought us the 4th largest week of sales for the new crop marketing year but in spite of that it is concerning that new crop sales remain way behind the pace of previous years.

Beans traded higher in the overnight and ten as we got into the day session succumbed to rumors of South American beans working into the USA and as a result traded lower. To be specific, the rumor making the rounds is that three vessels of soybean meal traded from South America for September and/or October shipment to Wilmington, NC.

Today’s softer close pushed all three of my technical indicators into the bearish camp for both the September and November soybean futures.

Wheat:

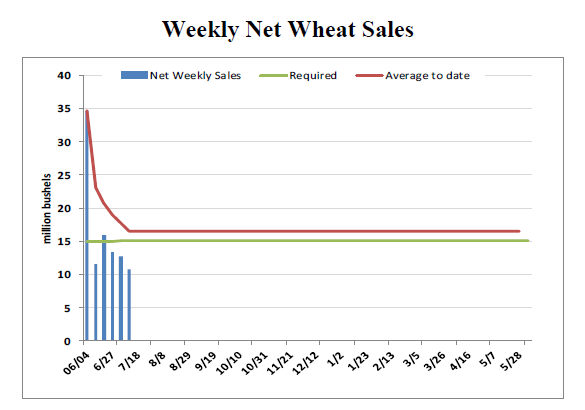

Wheat exports continue to be less than stellar with sales recorded at 10.7 million bushels for last week. For the year we are still ahead of the pace required to achieve the USDA’s projection but that is largely because of the large export number we had the first week of the marketing year. We are only six weeks into the new marketing year so have plenty of time to see this thing come around. It was encouraging today to see that Japan stepped up and bought 75.6 TMT of USA food quality wheat, in addition to 35.2 TMT from Canada and 26.9 TMT from Australia.

I did see a report today from Strategie Grains in which they cut their forecast for soft wheat in the EU due to dry, hot weather. They took soft wheat production down 0.7 million tons to 140.9 MMT. In spite of that the overwhelming feature of wheat seems to be talk of adequate domestic and world supplies coupled with slow export demand which is keeping the prices under pressure.

At the present time all three of my technical indicators are now bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: