Closing Comments

Lynn Miller

July 17th, 2015

Weather – or lack of weather – is the name of the game coming into the weekend. Most reports are for dryer and warmer conditions to help out the rain soaked regions of corn country. Talk of favorable pollination conditions are all over the market place. No one wants to carry a weather risk premium into a forecast like that, therefore, we saw a sell off today.

Corn:

As the weather straightens out across the Midwest, the focus will be on improving yield and crop condition. So Monday’s reports will be crucial to the trend for the week. We may not see a generous increase this next week, but the market is ready to see conditions up 2-3%. Patience is the key we need time and good weather for these roots to regenerate. At the present this market is trading yield between 163-164 BPA vs. the USDA’s average of 168.

Ethanol margins are the weakest they have been in quite a while with some locations now operating in the negative.

Overall, the fundamentals in the corn market are nothing short of pressing. Improving crop conditions, poor demand/export activity, bearish technicals and a weak market structure will probably keep prices down unless we see a significant change in the weather pattern.

Technically, today’s price action has turned all three indicators bearish both the September and December futures. In the nearby we should see support in the area of $4.03 – while $4.34 and $4.65 I would consider selling opportunities. In the New Crop I hope to find support around $4.11with selling targets of $4.41 and $4.70.

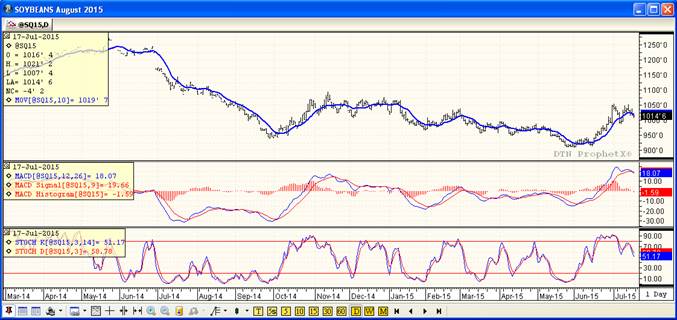

Soybeans:

After trading below $10.00 mid-session we bounced back on spreading against corn and a general lack of producer selling. This slow producer selling combined with good crush margins are keeping the front end of the market firmer; however, the same cannot be said for exports that are slumping steadily.

Fundamentally we have a mixed bag. Crush numbers continue to be great and above expectations, same goes for margins. Acres are still a mystery, while we are trading a potential 1.4 million acres lost are we counting double crop and reseeded acres and what will the USDA actually give us on August 12th? There are ample world stocks of beans and we have already started to loose harvest business to South America. The question is when will the market start to re-focus on demand?

Crop conditions are expected to be unchanged or slightly higher Monday night.

Technically we continue to be bearish all three indicators in the August and November contracts. In the Nearby, we should find temporary support in the area of $10.01 with sales targets at $10.23 and $10.94 (note, we have not been to this level since 11/12/14 and we very well could run out of time before we get back here). As for the new crops I would be looking for support at $9.97 with selling objectives of $10.58 and $11.19.

Wheat:

Prices were pressured the entire session again today. With no support from row crop wheat just seems to be floundering around trying to find it’s place. It’s no wonder as the dollar again gets stronger, ideal growing conditions for Spring Wheat and improving harvest weather for winter wheat we don’t have a lot going for us. And then you throw in the thought we should actually have some demand for this stuff and the picture gets even dimmer. We are seeing stiffer discounts for vom and high damage which should lower this crop into competitive status with corn for the southwest feedlots.

The Spring Wheat crop looks outstanding in Minnesota and ND, not to mention our own crops aren’t looking to shabby either. If the rain can just shut off or slow down at this point we should have good quality to go with the big bushels. At least the trade is not fearful of any wheat shortage worldwide this year at this point.

Technically, all three indicators remain bearish the Sep Minneapolis futures. We are looking for support at $5.70 which we traded through today, but managed to close above. Should this level fail, it could open the door for sub $5.50 futures. The stochastics are in oversold territory so be ready to take advantage of a technical correction since that may be all this market has left in it for the time being. My objectives would be $5.93 and $6.11..

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: