Craig's Closing Comments

Craig Haugaard

July 22nd 2015

In the most simplistic terms the market today was driven by a weather forecast that looks benign. This emboldened the funds to keep selling and caused most potential buyers to wait nervously on the sidelines.

Corn:

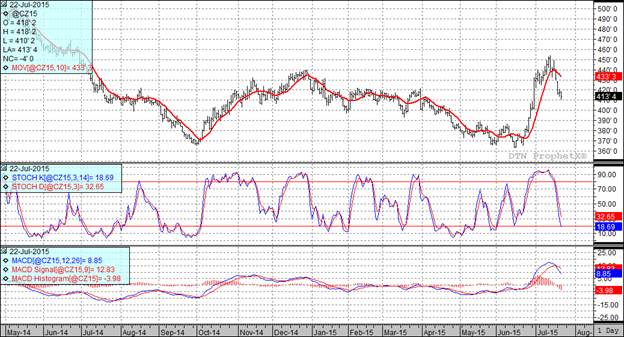

Corn seems like it is trying to make a stand after the beating it has received the past week or so. The funds are still long and trying to maintain that position while producer selling has pretty much dried up so perhaps we can form a base from which to stage a rally. If we see the funds and speculative longs wave the white flag I suppose we could see December futures retrace all the way back to the $3.80 area.

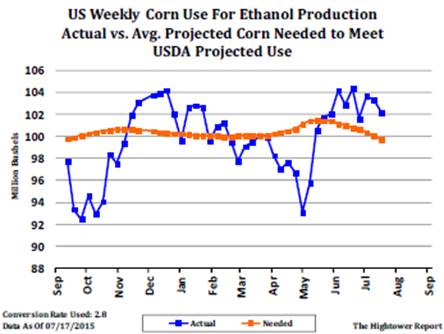

In terms of reports the only thing that I ran across today was the weekly ethanol report. Last week we consumed 102.165 million bushels of corn in the production of ethanol and thus need to average 99.715 million bushels per year for the rest of the marketing year to achieve the USDA projection. We are seeing negative margins at Iowa plants right now so we will have to see how much that impacts ethanol demand moving forward.

At the present time all three of my technical indicators are bearish both the September and December corn futures. We should find support in the December futures at $4.08 ½ and $3.97 ¾. It is also worth noting that there is a gap in the December futures at $4.29 ¼. At some point I expect the market to try and fill that gap.

Soybean:

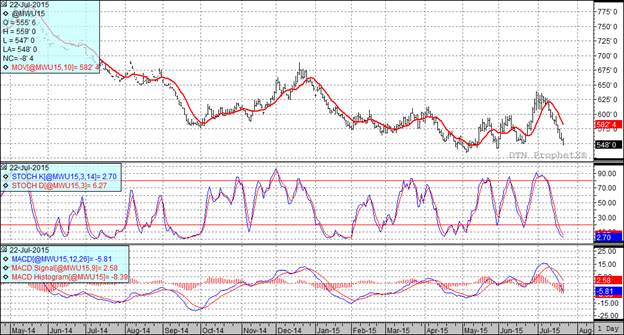

Beans settled lower for the session after trading on both sides of unchanged for the day. Beans are still enjoying good crush margins which are helping to support prices. I think that there is enough uncertainty over the magnitude of prevent plant acres as well as questions surrounding yield to keep prices from breaking significantly from current levels in the near term.

We did get a little good news on the export front with the USDA announcing a 120 TMT sale of new crop beans to China. We have seen the basis in Brazil firm up which may help push more export demand to the USA.

From what I hear, it appears that we will see bean harvest in the Delta begin in early August. The general consensus is that when harvest starts up down there we could see basis in parts of the USA widen out a bit.

All three of my technical indicators are currently bearish for both the September and November soybean futures.

Wheat:

About the best thing that I can say about wheat is that the funds are short and the market is technically oversold as a result of the sharp sell-off. If we can get the row crops to bounce higher we may very well see wheat stage a rally as well. At this point I am sure the rally would be sold as a selling opportunity and thus probably short lived but at this stage of the game I would be willing to take that.

It doesn’t seem that long ago that we were getting a steady diet of weather related horror stories from all around the wheat growing world. With that seemingly no longer an issue the market is focusing on demand which has been slow to develop.

Speaking of weather related woes, a report from Agriculture and Agri-Food Canada (AAFC) has lowered its forecast for this year’s wheat crop by -8.8% as a result of drought in that nation. They estimate total wheat production at 27.1 MMT, down from a previous forecast of 29.7 MMT. Last year they produced 29.3 MMT. The government agency says “below-trend yields have been assumed to account for extremely dry conditions in regions of Alberta and Saskatchewan” and warn further downgrades will be needed if the conditions persists.

At the present time all three of my technical indicators are bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

- S.D. farmboy turned investment banker creates farm management program

- Farm Software: 5 Tools Every Farmer Should Be Using

- How To Determine If Commodity Prices Are Too Low To Market Grain

- Using Futures Options In Grain Marketing

Top Trending Reads: