Craig's Closing Comments

by Craig Haugaard

July 30, 2015

Corn:

We kicked off the day with decent weekly export sales. Old crop corn came in at 14.4 million bushels. This was towards the top end of the range of trade guesses and pushes annual export sales to 100.3% of the annual sales projected by the USDA. New crop sales were also sold, coming in above the top end of the range of trade estimates.

We also saw the market supported today as traders debate the ultimate size of the corn crop. At the close we had the December corn futures at a touch over $3.80/bu. To justify that price level you have to assume that the national average yield will be roughly 166 bu/acre. To get to that we will need to see record yields in Minnesota, Nebraska and Iowa and it certainly seems as if that is a real possibility this year. We will also need to see Illinois check in with about a 178 state wide yield and that looks like a long shot at best. I saw a Weather Model Based Yield Forecasting program yesterday that has Illinois currently pegged at 163 bu/acre while they have Iowa at a very solid 185.

In South America we see a big crop continue to get bigger with the Buenos Aires Exchange raised its corn estimate for Argentina by 1 MMT to 26 MMT compared to the USDA’s recent estimate of 25 MMT.

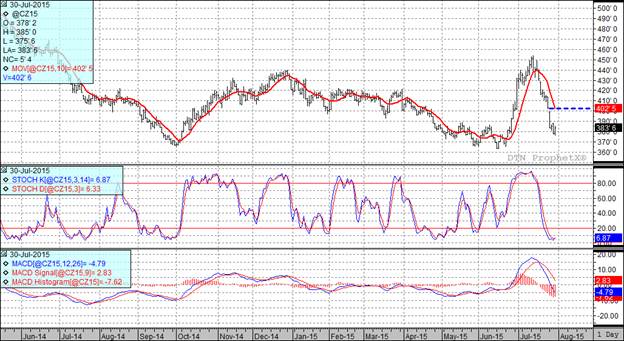

At the present time two of my three technical indicators are bearish both the September and December corn futures. Looking at the December futures I see that we have a gap at $4.02 (dashed blue line on the following chart) which should provide the bulls with a target to shoot for but will also serve as an area of resistance. Should we break through that area we also have a gap at $4.29 ¼ that is patiently waiting to be filled as well.

Soybean:

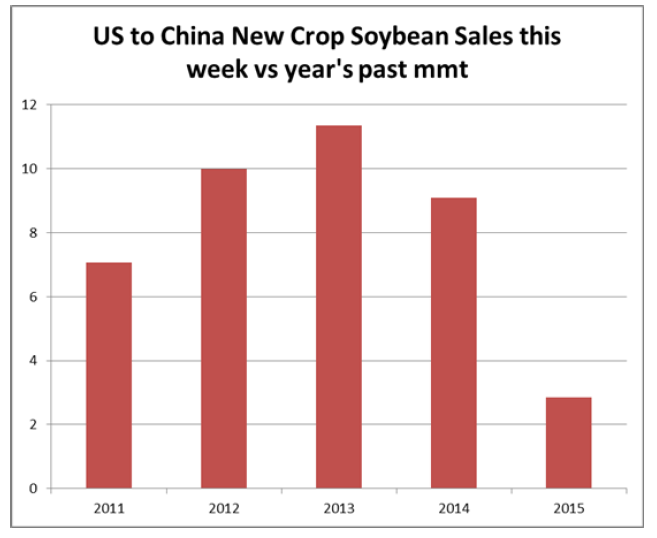

Soybeans were able to shrug off a stronger dollar and close higher, propelled in part by good export sales. Old crop sales came in at 15.3 million bushels. This place us at 103% of the annual sales projected by the USDA and leaves us needing to average weekly net cancellations of 8.7 million bushels per week to get back down to the USDA’s annual export projection. New crop sales also came in at the top end of the range of trade guesses. When looking at new crop sales it still must be noted that China is still lagging their historic pace of purchases. I will feel much better if we see them start to step up to the plate.

What makes this particularly discouraging is that China is buying South American beans for the October-December time slot as they are offering prices we have not been able to match. Demand in China looks solid, for example, hog feeding margins in China are the highest since 2009. At the current pace China will import at least 76.5 MMT, 2.5 MMT more than the USDA is currently projecting.

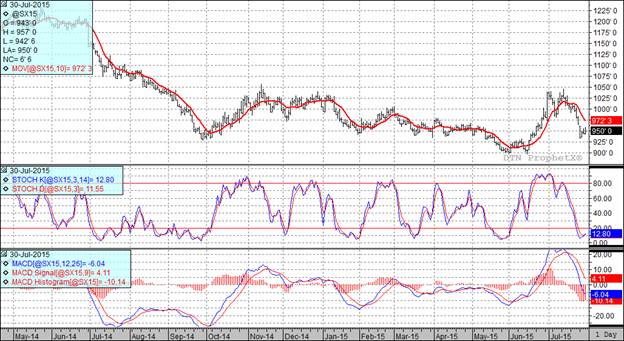

Two of my three technical indicators are currently bearish both the September and November soybean futures. November beans have a gap at $9.64 ¼ that they may look to fill.

Wheat:

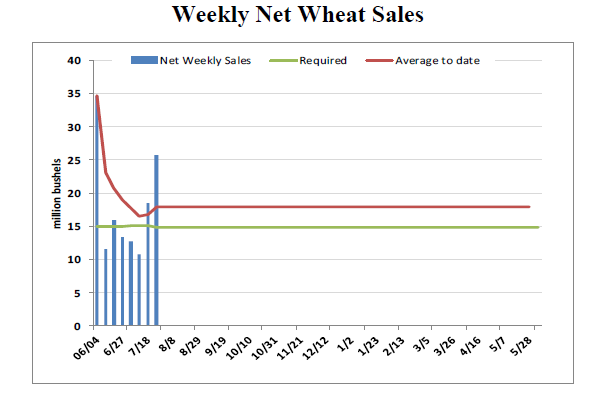

We kicked off the day with very solid weekly export sales. The weekly sales were announced at 25.7 million bushels, the second best week of exports so far in this young marketing year.

This week the Wheat Quality Council's three-day tour of North Dakota and adjacent areas in Minnesota and South Dakota has been taking place. The results are out this afternoon and as a result of the tour the 2015 U.S. hard red spring wheat crop was projected to yield 49.9 bushels per acre. This is stronger than the tour's 2014 forecast of 48.6 bushels and the tour's prior five-year average of 45.2 bushels. If you wanted to be bullish wheat this report certainly didn’t give you anything to hang onto.

At the present time all three of my technical indicators are bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets