Craig's Closing Comments

by Craig Haugaard

July 31, 2015

The conventional wisdom is that a weak dollar is bullish for commodity prices and vice versa. That may be true most of the time but today we saw the dollar get treated like Avraham Abramovitz at an ISIS convention. It wasn’t pretty but in spite of that beating grains predominantly closed lower.

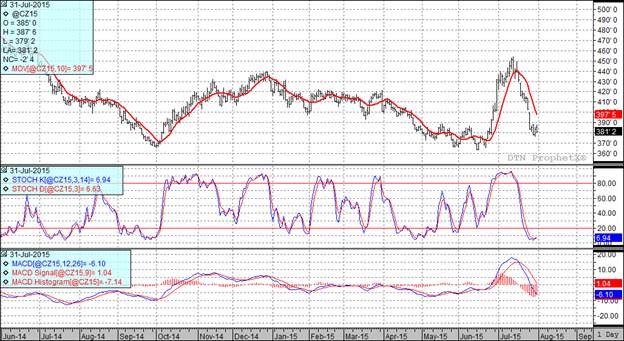

Corn:

Corn saw a two sided trade today but ended up slipping lower for the session.

Much attention continues to be paid to the growing conditions. At the present time the growing conditions for the next 30 days look pretty darn favorable.

We did pick up a little export business today with Mexico taking 108 TMT of corn.

While growing conditions are pretty good in this country that is not the case worldwide.

FranceAgriMer reported crop conditions falling 3% from last week with a total

decline of 8% over 3 weeks. Crop conditions are now 59% good to excellent in that nation. Also in Europe the corn in Ukraine experienced some stress last week but temperatures have moderated since then. The Ukrainian crop is currently expected to come in 24-26 MMT, look for it to be below the USDA’s current estimate of 26 MMT.

If we assume a national average yield of 163 bu/acre this year and plug production in the EU in at 60 MMT and ignore China because their corn is not going to flow into world markets you arrive at a worldwide stocks to use of 9.7% versus the current number of 11%. That should be friendly for corn prices. The fly in the ointment that could screw this bullish deal up is wheat. We are seeing an increased amount of feed quality wheat around the world this year. Analysts are suggesting that this will likely raise world wheat feeding by a minimum of 4 MMT. The USDA, in their July report, lowered wheat feeding by 5 MMT. If the analysts are right and the USDA is wrong that could result in 9 MMT more corn back on the balance sheet which would pretty much negate the preceding bullish scenario.

The funds seemingly still want to play this market from the long side. The July 28th Commitment of Traders report showed that funds were long 179,200 contracts, a reduction of 28,700 contracts from the last report.

At the present time two of my three technical indicators are bearish both the September and December corn futures.

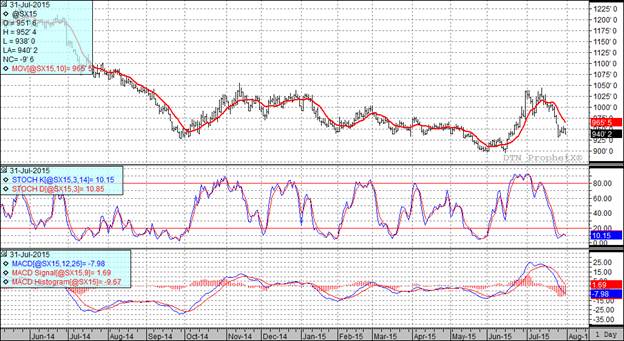

Soybean:

We kicked off the day with a report from the USDA that China had cancelled 200,000 MT of old crop sales. That started us lower and we really never recovered from it.

As mentioned in the corn comments, the growing conditions are pretty favorable and thus the Crop Conditions report is expected to show a crop that is holding steady when it is released on Monday. Last year, good crop conditions in August through the end of the growing season caused average yield projections to increase by 4.5 bu/acre. Last years’ experience coupled with this year’s weather forecast has some analysts conjuring up scenarios in which the carry-out climbs to over 500 million bushels for fiscal year 2015/16. With traders making a case for a carry-out to be anywhere from 200 to 575 million we are in for a very wild ride before the truth is known. The August USDA report could be very interesting especially if the re-surveyed acres catch traders by surprise.

At the present time all three of my technical indicators are currently bearish both the September and November soybean futures.

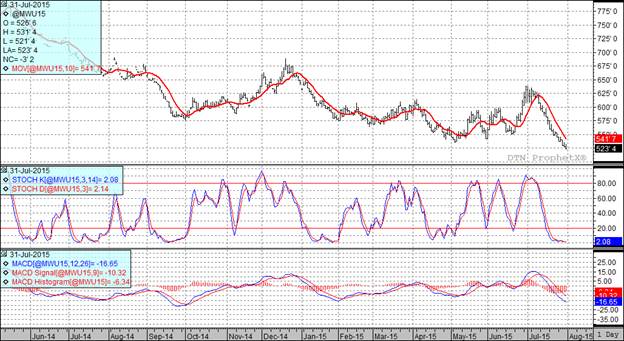

Wheat:

We started off the day with the announcement that 126,800 MT of wheat had been sold to unknown destinations for 15/16. This propelled us higher to start the session and while the Kansas City futures were able to post a higher close Minneapolis ultimately closed lower for the session.

In the world market Russia still has the cheapest wheat in the market. With feed wheat offers out of the Black Sea coming in at least $20 per metric ton less than corn we are seeing East Asia and Southeast Asia increasing imports of feed wheat instead of buying corn from Brazil. I touched on this under my corn comments but it appears to me as if the USDA is underestimating the scope that this substitution might take.

At the present time all three of my technical indicators are bearish both the Minneapolis and Kansas City September futures.

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

Top Trending Reads:

Topics: Grain Markets