Craig's Closing Comments

by Craig Haugaard

August 3, 2015

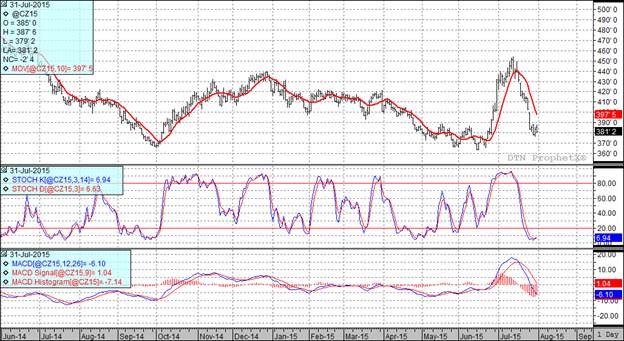

Corn:

The market worked lower today as good weather and continued long liquidation pressured the market. At the current time it appears that traders are trading a national average yield of roughly 166 bu/acre. This seems a bit aggressive to me. It will be interesting to see how it all plays out but I believe that the August 12 report could be very significant in helping us to find the bottom of this market and may start to form a platform from which we could rally if yields turn out to be less than what they are currently perceived to be.

Weekly corn export inspections came in at 36.246 million bushels, at the lower end of estimates and down from the previous two weeks. I believe we have four weeks left in the marketing year and if so then we will need to average 57.8 million bushels per week to achieve the USDA’s projection.

After the close we received the last crop conditions report. The crop was left unchanged at 70% good to excellent. A year ago we were at 73% good to excellent while the average for this point in the year is 58.2% good to excellent. In the key state of Illinois we saw conditions slip slightly from 57% last week to 56% in this week’s report.

At the present time all three of my technical indicators are bearish both the September and December corn futures.

Soybean:

Beans were under pressure from the perception of great weather conditions as well as technical selling. On the weather front the recent dryness has helped soybeans green up and pod but the next five days they will need rain in the Eastern Corn Belt to help fill pods. Oddly enough I am hearing reports that in some areas of Illinois and Indiana they are seeing cracked top soil and really need rain in the next week

The weekly crop conditions report came out this afternoon and reflected a slight improvement in crop conditions. We moved up one 1%, from 62% good to excellent last week to 63% this week. The five year average is 58.2% while last year at this point 71% of the crop was rated as good to excellent. We are entering a key weather period that will probably drive price direction in the near term.

At the present time all three of my technical indicators are currently bearish both the September and November soybean futures.

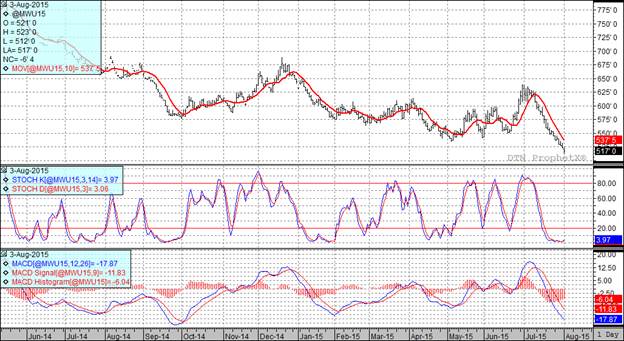

Wheat:

The weekly wheat export inspections today were a disappointing 10.951 million bushels. That leaves us needing to average 19.4 million bushels per week to achieve the USDA’s annual export projection for the current marketing year.

Spring wheat harvest is getting rolling with 8% of the crop reported as harvested in this afternoon’s USDA crop progress report. That obviously, should expand this week as the weather looks good. That expansion could result in additional price pressure.

On the international front I see that Western Australia received some heavy rains which helped recharge their soil moisture. A report from Russia indicates that they expect the crop to exceed its prior 100 MMT grain production estimate with a crop of 101.5 MMT. Also in that region I see that Kazakhstan expects to produce an equal sized grain crop to last year and plans to export 7 MMT. World competition in the wheat export markets is not going away any time soon.

At the present time two of my three technical indicators are bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets