Craig's Closing Comments

by Craig Haugaard

August 4, 2015

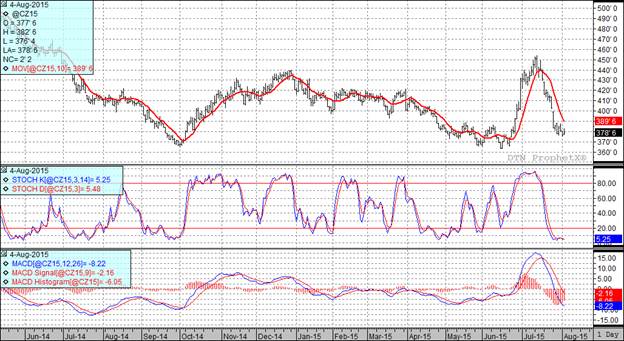

Corn:

The market traded higher today as we saw some concerns over dryness pop up which led to some short covering. The latest weather report looks a bit drier for the next 5 days but then the 6 to 10 day looks wetter for most the Corn Belt.

We will have a rash of private analysts taking their shot at predicting the national average yield this week. So far I have seen Doanes out there at 163.3 bu/acre. FC Stone came out at 4:55 with their number, 165 bu/acre, and we will get Informa numbers tomorrow.

A story that has not gotten much attention but that could end up being significant is the corn situation in the EU. We have seen production guesses for that crop slip from the 60 to 63 MMT range to now seeing guesses running from 56-61 MMT. If we end up at 57 MMT it would push the EU to import about 120 million more bushels than what the USDA is currently projecting. They would also effectively be out of the export market and end up with the tightest carry-out since 2007. If we couple that with yields in the USA that are not as robust as the current projections and this baby could get fun.

At the present time all three of my technical indicators are bearish both the September and December corn futures. We are in kind of an interesting spot in that we seem to be trading near what the market considers a fair market value. I think that the report on the 12th will be the best that this crop looks on paper all year and then if yields start to slip a bit we will have the stage set for a rally. I am not sure when the rally will occur but feel fairly confident that it will happen. In fact I have been thinking about selling my wife and kids and using the proceeds to go long corn futures. I’ll let you know if I move forward with that idea.

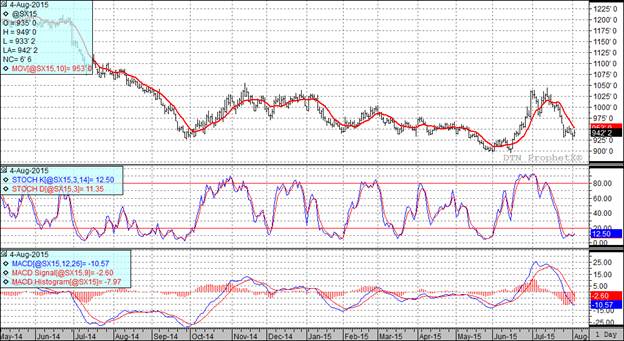

Soybean:

The bean market was firm all session as traders are a bit nervous about weather in the Eastern Corn Belt. We have very shallow root systems tin much of that crop and now are experiencing some dryness. Doanes was out with their forecast today and are pegging the national average yield at 43.5 bu/acre. FC Stone is pegging the crop at 45 bu/acre. The USDA is currently at 46 bu/acre. I will have more analysis of these numbers tomorrow.

In South America the strong dollar/weak Real is causing producers in Brazil to sell old crop as well as aggressively forward contract new crop bushels. Right now beans look a lot more attractive to producers in that nation that corn does. If that holds hold for a lot of bean acres again when planters start rolling down there.

At the present time all three of my technical indicators are bearish the September futures while two of three are bearish the November soybean futures. The funds bought roughly 5,000 contracts today.

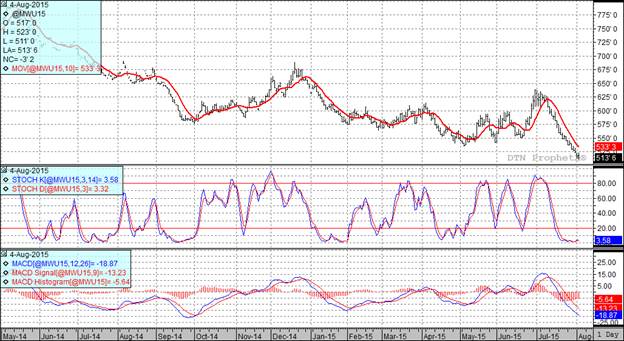

Wheat:

In spite of corn and beans trading higher, wheat took it on the chin once again. Exports are still very poor and funds were back in selling again today. Right now it looks like wheat may have to drop down low enough to work into the feed market to really generate some demand. Since wheat for feeding is valued at roughly 110% the price of corn we could see this market still move much lower than any of us could have imagined to find some significant demand.

At the present time two of my three technical indicators are bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets