Craig's Closing Comments

by Craig Haugaard

August 5, 2015

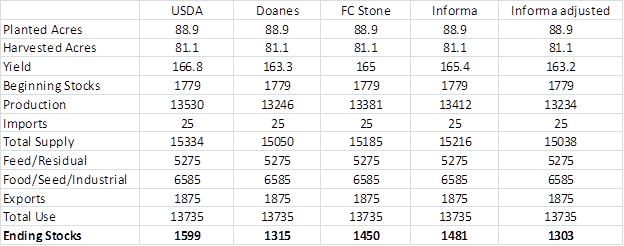

Corn:

We seem to have a steady stream of private analysts tossing out their projections ahead of next week’s USDA report. Today Informa check in with their numbers. I thought it might be kind of interesting to see the range of guesses out there so far and how they compare to the July USDA numbers. The final column in this table reflects the fact that over the past few years Informa’s August numbers have, on average been 2.2 bu/acre higher than the final USDA number. For corn the table is as follows:

We also had the weekly ethanol report out today which reported that 100.905 million bushels of corn were consumed in the making of ethanol last week. This means that we need to average 99.199 million bushels per week for the remainder of the year to achieve the USDA projection.

Weather continues to be a story in this market as well and in fact was probably the predominate reason that we were able to close higher today. The five day forecast for the Eastern Corn Belt is a bit drier than previously and if we look out a couple of weeks we see a drier and hotter forecast than what we were looking at a couple of days ago.

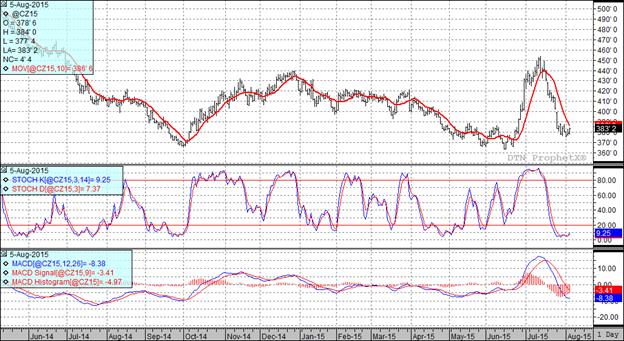

At the present time two of my three technical indicators are bearish both the September and December corn futures.

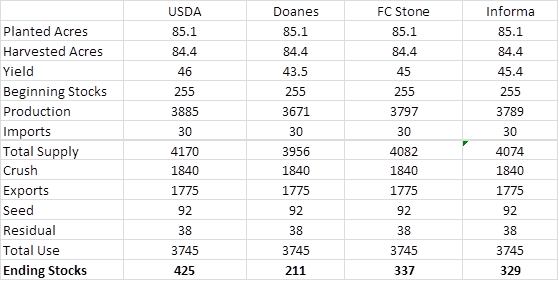

Soybean:

The weather forecast that added strength to corn also helped propel soybean higher during today’s session.

I also started to hear some talk of Sudden Death Syndrome in the Eastern Corn Belt. We will have to see if this develops into a real story but for today at least it was helping to support prices.

The trade is having an ongoing dialogue around what the August 12th report will bring to us. We have had a number of private analysts weigh in so far and the following table takes their projections and looks at them compared to the July USDA report. As you can see, every analyst out there is projecting an ending carry-out that is less than what the USDA projected in its last report. The August report could be very interesting indeed. If we get a carry-out that is just south of 300 million you could make the case that the November futures prices should be about a dollar higher.

Informa also took a shot at projecting in South America as well. They raised their 2015 crop year Brazilian soybean production figure to 97.5 MMT compared to the USDA’s 97 MMT while at the same time dropping Argentina by 1 MMT.

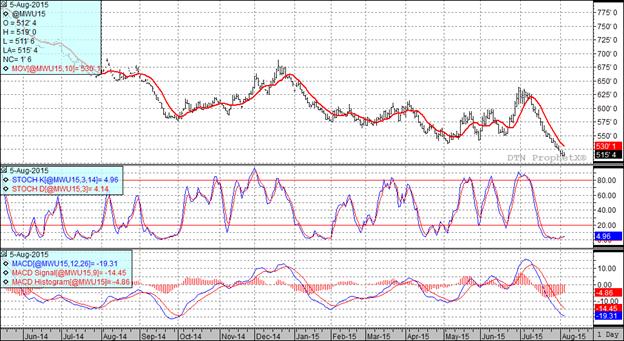

With today’s rally two of my three of my technical indicators are now bullish both the September and November futures.

Wheat:

We saw wheat ride the coattails of the row crops and post a little better close for the session.

On the export front it was the same old story. Egypt bought Russian wheat in their tender as the USA came in $0.60/bu. higher than the Russian’s offer. France took a shot at the business as well but lost out due to the lowered maximum moisture standards of the tender.

Speaking of France, they have the most wheat acres they have had planted in 80 years and are looking at harvesting a record soft wheat crop that some analysts feel could reach 40 MMT.

On the domestic front we saw Informa release their wheat crop estimates this morning. They have all wheat yields estimated at 44.6 bu/acre vs the USDA’s 44.3. They have spring wheat yields pegged at 47.4 bu/acre vs USDA’s 46.7 bu/acre.

So, to sum up the day, we got our butt’s kicked in the export market and a private analyst told us that we were going to have more bushels than the USDA has been projecting. In spite of today’s higher close I think we will see wheat prices struggle in coming days.

At the present time two of my three technical indicators are bearish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%