Closing Comments

Lynn Miller

January 12th, 2016

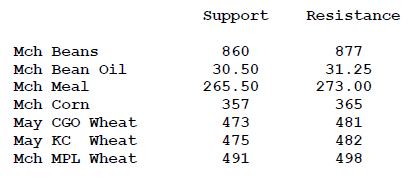

Hip Hip Horray for the USDA… Well not really, but at least they gave us something to trade. Or if you want to be realistic, they gave the funds a reason to reverse some of the ginormous short positions they hold. I wouldn’t call this a bullish report, but for the first time in a long time, I would call it producer friendly. Even though the majority of the wheat numbers were bearish, the trade was so super short we saw good gains in all wheat markets.