Closing Comments

Lynn Miller

October 5th, 2015

Corn:

Strength in beans, ideas of fewer US harvested acres, pre-report positioning and some seasonal buying all piled on the market to help corn near recent highs.

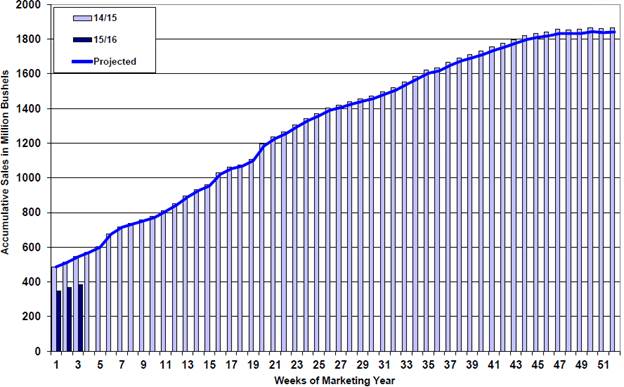

Weekly export inspections were not wonderful, coming in at a mere 18.5 million bushels, down from 31.9 last week and well below the 35.0 number from last year. The boat line up in Brazil is growing, now 98 vessels waiting to load, this is 70 ships more than 1 year ago.

For those trying to make a plan to price binned bushels, the spreads are strengthening again slowly. If you want to roll December futures you’ll want to keep an eye on these.

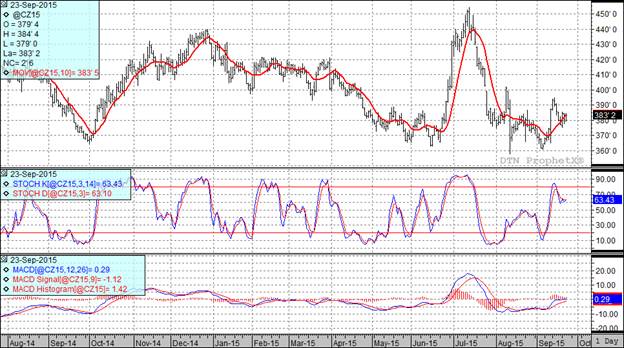

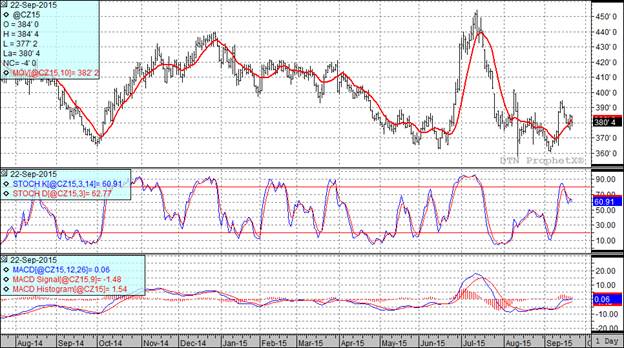

Technically all three indicators are once again positive the December corn futures. I’m hoping that the fact we are trading over the 100-day moving average will give us some momentum to maybe climb out of our rut. Still though, my price objectives have not changed, $3.80 should hold as support in the short term with selling levels at $3.94, $4.06, $4.18 and at the top end of the range $4.29.