Closing Comments

Craig Haugaard

Recent Posts

Closing Comments

Lynn Miller

December 29th, 2015

Corn:

Once again, a no new news kind of trading day. After a sell off this morning, corn settled back into its standard sideways trading range. Grain transportation issues were the main concern of the day with the Missouri closed at St. Louis due to heavy flooding. Farmer movement is non-existent and the funds are not ready to go shorter with only 8 days until the USDA’s annual production report.

Technically, all three indicators continue to be bearish the March futures. Although they are not signaling a buy yet, the stochastics made a steep swing upward. Nearby support continues to hold at $3.61 even though we traded through it significantly early session. My selling targets would be $3.66, $3.70, $3.75, $3.82 followed by $3.92.

Topics: Grain Markets

Closing Comments

Lynn Miller

December 22nd, 2015

El Nino is now believe to be past its’ peak, but expected to linger into spring in the US. This would imply a crop year that should be trend to above trendline yields.

Topics: Grain Markets

Closing Comments

Lynn Miller

December 17th, 2015

Corn:

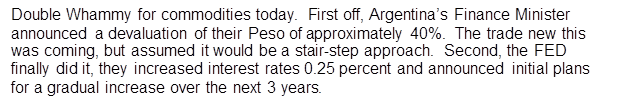

Well, a sharp rally in the dollar along with the currency devaluation in Argentina brought us a new contract low this morning of $3.62 ¼. But we came off the lows nicely and it appears the selling has been exhausted for now. Argentina brokers are disappointed that they did not see any rampant selling on the devaluation this morning. Granted, the currency devaluation is bearish to them over time and there are a lot of logistics to work through before grains will be free flowing there.

Topics: Grain Markets

Grain Market Chatter Closing Comments12/16/2015

Posted by Craig Haugaard on Dec 16, 2015 10:27:51 PM

Topics: Grain Markets

Grain Market Chatter Closing Comments12/15/2015

Posted by Craig Haugaard on Dec 15, 2015 10:14:48 PM

Closing Comments

Lynn Miller

December 15th, 2015

In general we saw a steady dollar the pressured commodities today as investors brace for Wednesday’s FED meeting. Most expect an interest rate increase and that has stocks higher today. Meanwhile, crude is rebounding from yesterday’s new lows up by more than $1/barrel. Some of the hype in crude is on speculation that congress will lift a 40-year ban on US crude oil exports as part of a broader spending bill. Lifting this ban will do nothing for the global supply glut we are facing now; however, it could be a psychological driver to a short-term rally. A rally in crude will be good for corn.

Topics: Grain Markets

Closing Comments

Lynn Miller

December 14th, 2015

Corn:

Short covering was the name of the game today. Spot barge freight a little weaker, CIF firm and well above DVE squeezing the shorts out of the market. The trade will now anticipate the CH taking over the expiring traits of the CZ (Which was $0.04 inverse to the March on expiration today). The next question will be when will all this corn move. The end user market is anticipating a large movement after January 1st, but will that happen at these levels? If not, we may see them come to the trough with improved basis levels once again.

Topics: Grain Markets

Closing Comments

Lynn Miller

December 10th, 2015

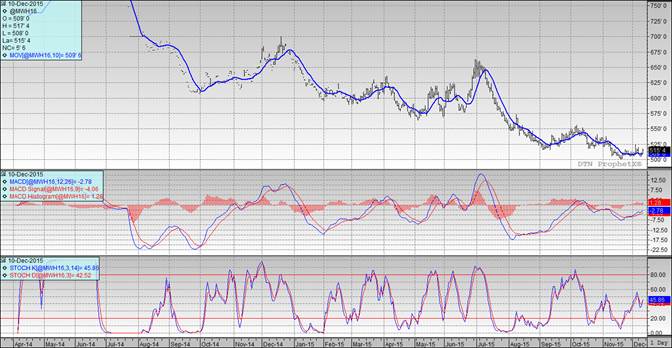

Corn:

Better than expected export sales: 1.10 mmt. This was the jump start to the day that kept corn above support. When we failed to fall it may have very well spurred some short-covering.

Funds are thought to have coverd 10-12,000 shorts today.

Topics: Grain Markets