Closing Comments

Lynn Miller

November 9th, 2015

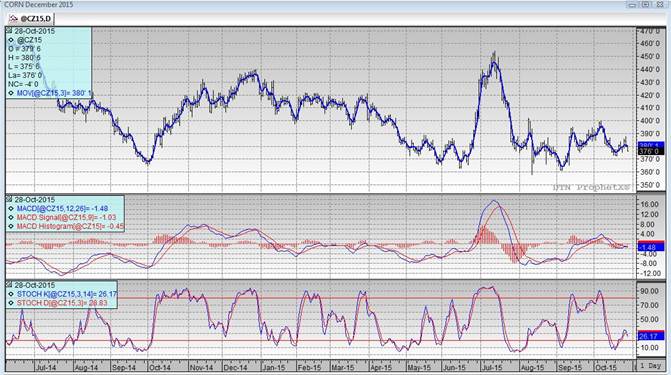

We basically traded fear today as the front-most topic was the potential negatives to come from tomorrow’s USDA report. Talk of raised interest rates didn’t lend us any support. Then there is better world wheat forecasts, lower crude, lower commodities in general, sharply lower meats, and a lower dollar. Lower was basically our theme.