Closing Comments

Craig Haugaard

Recent Posts

Topics: Grain Markets

Closing Comments

Lynn Miller

July 8, 201

Some general influences on the market place:

Negative: the ongoing financial crisis in Greece, the stock market plunge in China

Positive: Rain, rain go away in Indiana, a weaker dollar and pre-report positioning.

Friday – Monthly USDA WASD report (Supply & Demand)

Topics: Grain Markets

Craig’s Closing Comments

Topics: Grain Markets

Craig’s Closing Comments

Topics: Grain Markets

Craig’s Closing Comments

Craig Haugaard

July 2, 2015

As we enjoy our various 4th of July festivities this week-end I hope we take time to reflect on the great gift that our founding fathers have given us. The final sentence of the Declaration of Independence is a promise among the signers, to “mutually pledge to each other our Lives, our Fortunes, and our Sacred Honor.” It was no slam dunk that we were going to win our freedom and many of the founding fathers suffered great personal loss in seeking to establish it. They knew that once established there was no guarantee that it would be preserved. As Benjamin Franklin said, ‘We have given you a democratic-republic… if you can keep it.” Would be that we are as diligent in protecting it as the founding fathers were in providing it. Have a great 4th everyone.

Topics: Grain Markets

Grain Market Chatter Closing Comments 07/01/2015

Posted by Craig Haugaard on Jul 2, 2015 12:42:00 AM

Craig’s Closing Comments

Craig Haugaard

July 1, 2015

After the excitement of yesterday, today was filled with profit taking. Wheat was the biggest loser as it gave back the majority of yesterday’s gains. Soybeans also surrendered some back with corn able to surge late and post another positive close. At the end of the day this was probably nothing more than a little profit taking as the trade had time to ponder yesterday’s numbers and took a little spending money off the table heading into the long week-end. After everyone gets back from the long week-end I suspect the trade will refocus on crop conditions and weather forecasts. This will probably mean some post 4th of July fireworks.

Corn:

We really didn’t have much news to trade today. Farmer grain sales have been strong across the entire Corn Belt which is leading to some weaker basis numbers.

On the demand side of things, today’s weekly ethanol report indicated that 101.64 million bushels of corn were used in the creation of ethanol last week. This makes seven weeks in a row that has been above 100 million bushels and leaves us needing to average 98.274 million bushels per week for the remainder of the marketing year to achieve the USDA’s projection.

Topics: Grain Markets

Grain Market Chatter Closing Comments 06/30/2015

Posted by Craig Haugaard on Jun 30, 2015 7:06:00 PM

Craig’s Closing Comments

Craig Haugaard

June 30, 2015

Corn:

Uffda, what a day. The USDA lit a fire under this market and we spent the rest of the session trying to hang on to a runaway.

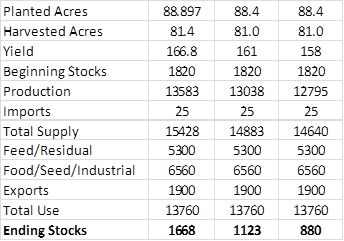

The trade was looking for planed acres to come in at 89.292 million acres so the reported number of 88.897 million was 395,000 acres less than what the trade was looking for. Traders were also expecting the quarterly stock number to come in at 4.555 billion bushels so the actual number of 4.447 billion was seen as supportive to prices. The following table has been adjusted to reflect today’s acreage and stocks number while the next two columns reduce the acres slightly and also illustrate what happens should the projected yield slip from here.

Topics: Grain Markets

Grain Market Chatter Closing Comments 06/29/2015

Posted by Craig Haugaard on Jun 29, 2015 5:46:00 PM

Craig’s Closing Comments

Craig Haugaard

June 29, 2015

In a land noted for its jackalope population it seemed logical that we should also create a creature for those times when traders are uncertain as to which direction the market is moving. With that in mind I introduce to you the Bullbear. With the market recently having had a very nice run up in price but with the trade also experiencing a certain level of fear and uncertainty heading into tomorrow’s report this seemed like a good time to introduce him.

Topics: Grain Markets

Grain Market Chatter Closing Comments 06/25/2015

Posted by Craig Haugaard on Jun 25, 2015 5:07:00 PM

Craig’s Closing Comments

Craig Haugaard

June 25, 2015

Corn:

Let’s kick the comments off today with stuff nobody cares about, the weekly export sales report. This week it came in at 19.6 million bushels which was below the low end of expectations. With today’s number we are now seeing commitments at 97% of the USDA export number. We shouldn’t have any problem hitting the USDA projection.

Topics: Grain Markets

Grain Market Chatter Closing Comments 06/23/2015

Posted by Craig Haugaard on Jun 22, 2015 5:46:00 PM

Craig’s Closing Comments

Craig Haugaard

June 22, 2015

Watching the market the past few days I keep thinking of my cousin Jimmy whose favorite saying is, “If you mess with the bull you get the howns.” I am sure that more than a few traders that were short these markets feel like they got the horns. As a sideline, it bugs the snot out of me that slow cousin Jimmy can’t pronounce the letter “R.” A few years ago the family sent him to a speech therapist as a Christmas gift which in retrospect was a crappy gift. Kind of like someone sending me to Weight Watchers as a present. If my kids ever did that I would cut them out of the will. Anyway the therapist told him that the inability to pronounce R is called “Rhotacism." That kind of sent Jimmy off on a rant. If I remember correctly his exact words were, “Awe they fweakin kidding me!! I can’t pwonounce the lettew and the name they give it stawts with the fweaking lettew so I can’t even tell anybody what I have.” I did work with him trying to get his to practice saying, “Richard runs around the rock” but the best he could ever do was “Wichawd wuns awound the wock” so I finally gave up and have and just resigned myself to the fact that is just the way Jimmy is goiong to be. Now, back to the markets.

Topics: Grain Markets