Craig's Closing Comments

Grain Market Chatter Closing Comments 08/14/2015

Posted by Craig Haugaard on Aug 14, 2015 10:42:00 PM

Topics: Grain Markets

Grain Market Chatter Closing Comments 08/13/2015

Posted by Craig Haugaard on Aug 13, 2015 8:45:00 PM

Craig's Closing Comments

by Craig Haugaard

August 13, 2015

They killed the kitty yesterday but we had the dead cat bounce today.

Topics: Grain Markets

Grain Market Chatter Closing Comments 08/12/2015

Posted by Craig Haugaard on Aug 12, 2015 5:13:00 PM

Craig's Closing Comments

by Craig Haugaard

August 12, 2015

Corn:

Uff da. Well, nobody saw this coming. The trade was stunned by today’s USDA report. Coming into the report the average trade guess was that we would see a national average yield of 164.5 bu/acre with total production pegged at 13.327 billion bushels. Instead we were presented with a forecast national average yield of 168.8 bu/acre. This was even above the top end of the range of trade guesses which ran from 160.4 to 67.5 bu/acre. This of course pushed us to a total production number of 13.686 billion bushels, also above the top end of the range of trade guesses. On the demand side of the equation today’s report reflected a 25 million bushel increase in feed demand with an additional 40 million bushels of demand being attributed to the food/seed/industrial category. Twenty five million of that is additional ethanol demand. The net result is that we went from a projected 2015-16 carryout of 1.599 billion bushels in the July report to 1.713 billion bushels in today’s version.

In addition to the USA carryout being sharply increased above the average trade estimate we also saw them take the projected world carryout from 189.95 MMT last month to 195.1 MMT in today’s report.

The question now is, how accurate is the USDA? Is it time to give up hope and all find a tall building with a window to jump out of? I may be overly optimistic but I am of the belief that the numbers we saw today and the best we are ever going to see this crop look. In looking at the state by state breakdown I am seeing some significant differences between what the private analysts are seeing in the Eastern Corn Belt versus what the USDA pegged them at today. Another state that has me a bit curious is Nebraska. Last year we set a new all-time production record of 179 bu/acre and today the USDA projected we would smash that record in Nebraska by 8 bu/acre this year.

Topics: Grain Markets

Grain Market Chatter Closing Comments 08/10/2015

Posted by Craig Haugaard on Aug 10, 2015 7:35:00 PM

Craig's Closing Comments

by Craig Haugaard

August 10, 2015

Corn:

Throughout the ages there have been questions that puzzled mankind. Questions of supreme importance such as, “Why is the sky blue?” or “Why does Teflon stick to a pan when nothing sticks to Teflon?” To this unknowable questions we can now add, “Why was the commodity market so much higher today?”

It appears that much of today’s bull move was driven by short covering and positioning ahead of the August 12 report. Early short covering pushed the market high enough to trigger some buy stops and we were off to the races. By the closing bell the funds had been buyers of 30,000 contracts for the session.

Beyond that the reasons for the rally become a little skimpy. On the weather front the Eastern Corn Belt didn’t get as much rain as expected over the week-end but this afternoon it looks like there is a system developing over Ohio and Indiana that could bring rain this evening.

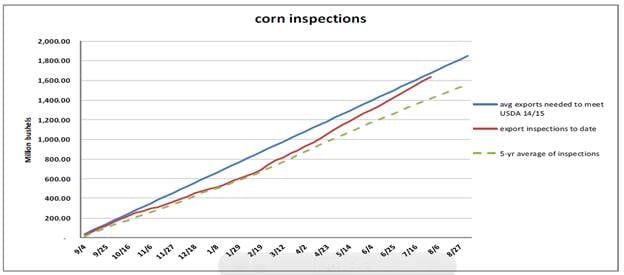

The weekly export inspections were towards the low end of the range of trade guesses but with only three weeks left in the marketing year it looks like we may end up between 25 and 50 million bushels behind where the USDA has been projecting us to be.

Topics: Grain Markets

Craig's Closing Comments

by Craig Haugaard

August 7, 2015

Corn:

We couldn’t get a decent rally going this week in corn which would seem to indicate that traders don’t think the weather or crop conditions are bad enough to build a risk premium into these futures prices. Right now we are seeing enough weather models with benign weather and “good” crop conditions reports that the market is just kind of in a blah state of mind with no real desire to beat the market substantially lower or to rally it substantially higher at this point. Maybe next week’s USDA report will provide the fuel to move us one direction or the other.

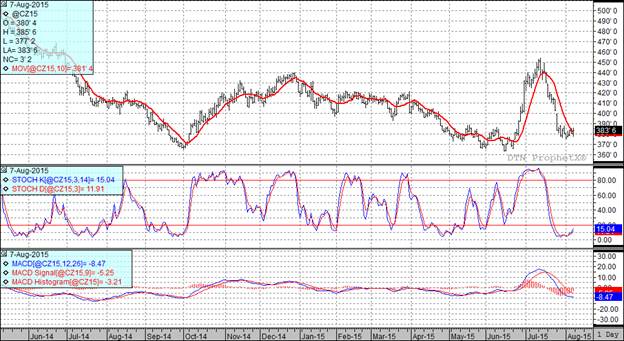

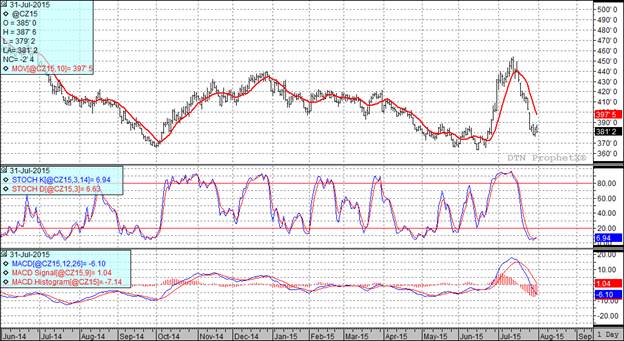

At the present time two of my three technical indicators are bullish both the September and December corn futures.

Topics: Grain Markets

Craig's Closing Comments

by Craig Haugaard

August 6, 2015

Corn:

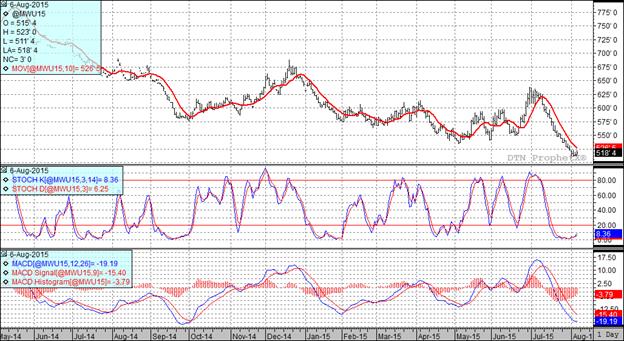

I am having one of those days when my brain seems to be heading down a path that is different from that commonly accepted in polite society as normal. For some reason when I sat down to write the comments tonight all I could think of were the words “supply and demand.” Of course that then had me envisioning fancy economics charts with long treatises about how the drought in the EU could shift the world carry-out from Q3 to Q2 thus raising P3 to P2. It was going to be a thing of beauty but then I remembered having a conversation about this stuff with my slow cousin Jimmy one time when he looked at me and said, “Cwaig, it don’t mean nothing. If you teach a pawwot to say supply and demand and you’ve got an economist.” Come to think of it, he isn’t far off so I will avoid going down that road today.

Topics: Grain Markets

Craig's Closing Comments

by Craig Haugaard

August 5, 2015

Corn:

We seem to have a steady stream of private analysts tossing out their projections ahead of next week’s USDA report. Today Informa check in with their numbers. I thought it might be kind of interesting to see the range of guesses out there so far and how they compare to the July USDA numbers. The final column in this table reflects the fact that over the past few years Informa’s August numbers have, on average been 2.2 bu/acre higher than the final USDA number. For corn the table is as follows:

Topics: Grain Markets

Craig's Closing Comments

by Craig Haugaard

August 4, 2015

Corn:

The market traded higher today as we saw some concerns over dryness pop up which led to some short covering. The latest weather report looks a bit drier for the next 5 days but then the 6 to 10 day looks wetter for most the Corn Belt.

We will have a rash of private analysts taking their shot at predicting the national average yield this week. So far I have seen Doanes out there at 163.3 bu/acre. FC Stone came out at 4:55 with their number, 165 bu/acre, and we will get Informa numbers tomorrow.

A story that has not gotten much attention but that could end up being significant is the corn situation in the EU. We have seen production guesses for that crop slip from the 60 to 63 MMT range to now seeing guesses running from 56-61 MMT. If we end up at 57 MMT it would push the EU to import about 120 million more bushels than what the USDA is currently projecting. They would also effectively be out of the export market and end up with the tightest carry-out since 2007. If we couple that with yields in the USA that are not as robust as the current projections and this baby could get fun.

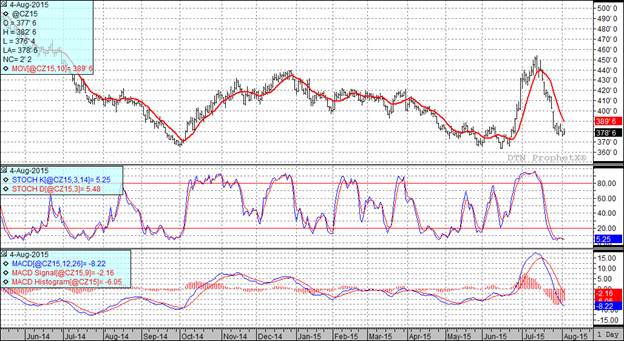

At the present time all three of my technical indicators are bearish both the September and December corn futures. We are in kind of an interesting spot in that we seem to be trading near what the market considers a fair market value. I think that the report on the 12th will be the best that this crop looks on paper all year and then if yields start to slip a bit we will have the stage set for a rally. I am not sure when the rally will occur but feel fairly confident that it will happen. In fact I have been thinking about selling my wife and kids and using the proceeds to go long corn futures. I’ll let you know if I move forward with that idea.

Topics: Grain Markets

Craig's Closing Comments

by Craig Haugaard

August 3, 2015

Corn:

The market worked lower today as good weather and continued long liquidation pressured the market. At the current time it appears that traders are trading a national average yield of roughly 166 bu/acre. This seems a bit aggressive to me. It will be interesting to see how it all plays out but I believe that the August 12 report could be very significant in helping us to find the bottom of this market and may start to form a platform from which we could rally if yields turn out to be less than what they are currently perceived to be.

Weekly corn export inspections came in at 36.246 million bushels, at the lower end of estimates and down from the previous two weeks. I believe we have four weeks left in the marketing year and if so then we will need to average 57.8 million bushels per week to achieve the USDA’s projection.

After the close we received the last crop conditions report. The crop was left unchanged at 70% good to excellent. A year ago we were at 73% good to excellent while the average for this point in the year is 58.2% good to excellent. In the key state of Illinois we saw conditions slip slightly from 57% last week to 56% in this week’s report.

At the present time all three of my technical indicators are bearish both the September and December corn futures.

Topics: Grain Markets

Grain Market Chatter Closing Comments 07/31/2015

Posted by Craig Haugaard on Jul 31, 2015 9:49:00 PM

Topics: Grain Markets