Craig’s Closing Comments

Craig Haugaard

June 5, 2015

We can’t overestimate the impact of the dollar on commodity prices and for today at least it was roaring higher. This in turn put pressure on commodities straight across the board.

CashCow helps all farmers manage and market their grain.

Find out moreCraig’s Closing Comments

Craig Haugaard

June 5, 2015

We can’t overestimate the impact of the dollar on commodity prices and for today at least it was roaring higher. This in turn put pressure on commodities straight across the board.

Topics: Grain Markets

Craig’s Closing Comments

Craig Haugaard

June 4, 2015

Corn:

A story that has been making the rounds is that due to the planting delays we could see 1.5 million less planted acres than what the USDA has been projecting. With planted acres already diminished this has given support to the bulls amongst us. While that may very well turn out to be true it is also true that the 6 to 10 day forecast looks very good for early crop development. The majority of the Corn Belt is forecast to experience normal to above normal temperatures with the eastern Corn Belt also pegged to receive above normal precipitation. Just out of curiosity I took the recent USDA report and reduced both the planted and harvested acres by a million and a half to generate the following table. The second column is the same numbers with last year’s national average yield plugged in instead of the current USDA projected yield.

Topics: Grain Markets

Craig’s Closing Comments

Lynn Miller

June 3, 2015

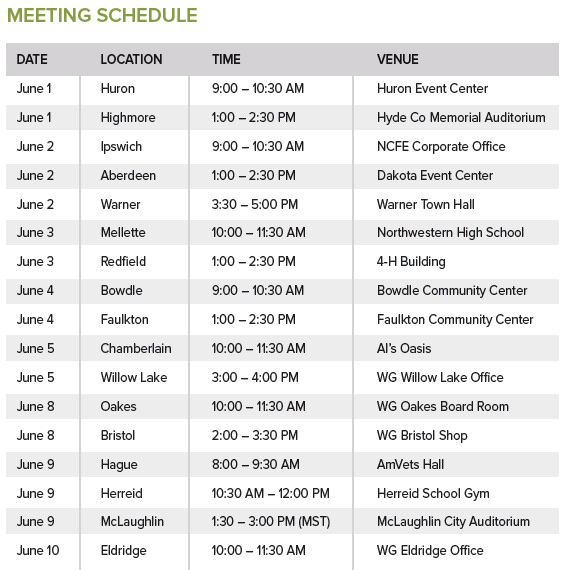

The vote is only 2 weeks away.

Plan to attend a unification meeting. Be Informed, every vote counts.

Corn:

News in the corn world was pretty minimal, but we do have a few things to mull over. First out of the gate today was ethanol production. Crush is up from last week @ 102.06 million bushels – that’s two good weeks in a row!. Stocks were down and margins slipped a little bit, but remain positive.

Topics: Grain Markets

Craig’s Closing Comments

June 1, 2015Corn:

It was a very slow day from a news standpoint. We had weekly export inspections were check in at 38.4 million bushels. The trade was looking for something in the 33.5 to 41.3 million bushel range so we fit within that but were down slightly from last week’s 37 million bushels of inspections.

Topics: Grain Markets

Posted by Craig Haugaard on May 29, 2015 5:35:00 PM

Craig’s Closing Comments

Topics: Grain Markets

Posted by Craig Haugaard on May 28, 2015 5:35:00 PM

Closing Comments

Lynn Miller

May 28, 2015

Unification Meetings are now scheduled. Plan to Attend / Be Informed / Every Vote Counts.

Topics: Grain Markets

Posted by Craig Haugaard on May 27, 2015 8:02:00 PM

Closing Comments

Lynn Miller

May 27, 2015

Corn:

It appears corn just can’t get away from the same old/same old lately. Very limited fresh news outside of some updated forecasts. The US farmer continues to hold tight while the SA farmer is selling. The change in weather from hot/dry to cool/wet has helped crops progress rapidly as of late. However, some areas that are too wet are now looking at moving acres to beans. On a normal year we would see this as a plus, but weather conditions appear to be favorable enough right now to make up the acre gap in production.

Topics: Grain Markets

Posted by Craig Haugaard on May 26, 2015 5:33:00 PM

Closing Comments

Craig Haugaard

May 26, 2015

After trading lower for four weeks or so we have seen the dollar catch fire once again the past couple of weeks and trade sharply higher. We have a very sharp rise in the dollar today and that put a great deal of pressure on commodity prices.

Topics: Grain Markets

Posted by Craig Haugaard on May 22, 2015 5:13:00 PM

Closing Comments

Craig Haugaard

May 22, 2015

The markets will be closed Monday in honor of Memorial Day. As you are enjoying this long week-end I hope you will take some time to reflect on the sacrifices made by men and women in uniform to preserve this nation that Abraham Lincoln referred to as “the last best hope of earth.”

Topics: Grain Markets

Posted by Craig Haugaard on May 20, 2015 4:57:00 PM

Closing Comments

Craig Haugaard

May 20, 2015

Corn:

We didn’t have a great deal of news today and as a result the market continued to drift lower. One report that was out today was the weekly ethanol report and that showed an excellent week last week with 100.59 million bushels of corn being ground last week to make ethanol. That is the biggest weekly grind since the week of February 13th. We now need to average 101.453 million bushels per week for the remainder of the marketing year to achieve the USDA projection.

Topics: Grain Markets

CashCow helps all farmers manage and market their grain.

Find out more