Craig’s Closing Comments

April 13, 2015

I did some thinking over the week-end and have a couple general comments on things I feel are impacting grain prices right across the board.

1) We need to keep an eye on the dollar. As you can see on the following monthly continuation chart, the dollar has bounced back lately and is now trading about as high as any level we have seen since April 2003. This makes it increasingly difficult to be competitive in the export market and thus puts downward pressure on commodities.

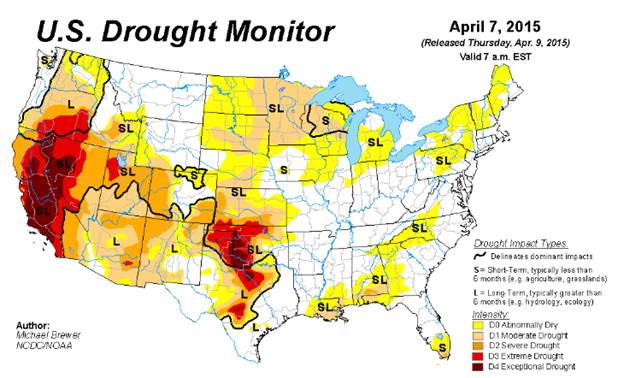

2) My second thought was that I have probably been guilty of trying to trade my backyard. I have been of the opinion that we will see some production problems this summer that will provide better pricing opportunities than we are seeing right now. I still think that may be the case but in my veal to promote what I am seeing in our trade area I took my eye of the bigger picture. We had the weekly planting progress and crop conditions report out today and as a part of that they give you a reading on top soil and sub soil conditions. In South Dakota the top soil is rated at 69% short to very short while sub soil moisture checks in at 65% short to very short. That reality has colored my perception of how I see the growing conditions and I suspect it has impacted your view of the world. The problem is that if we look from a national perspective we see that only 24% of the country is short to very short top soil moisture while 23% is reported in the same category for sub soil. Interestingly enough 24% is reported as having surplus top soil moisture with 19% reporting surplus sub soil. In fact the most important number in today’s report may be the state of Ohio where they are reported as 66% of the topsoil having surplus moisture. Wouldn’t it be interesting if we had a weather rally not because the western Corn Belt is to dry but because the eastern Corn Belt was to wet? As hard as it is to ignore the conditions in ones backyard the most successful marketers will be able to put that aside and trade the national picture.

3) Since we are talking drought we may as well talk pestilence as well. This week-end we saw the avian flu (H5N2) move from only impacting turkey producers to being confirmed in a commercial 200,000 bird chicken flock in Jefferson County Wisconsin. This makes 20 flocks that have been impacted thus far with turkey flocks accounting for the other 19. If this continues to spread it will have a negative impact on feed demand.