Closing Comments

Lynn Miller

January 27th, 2016

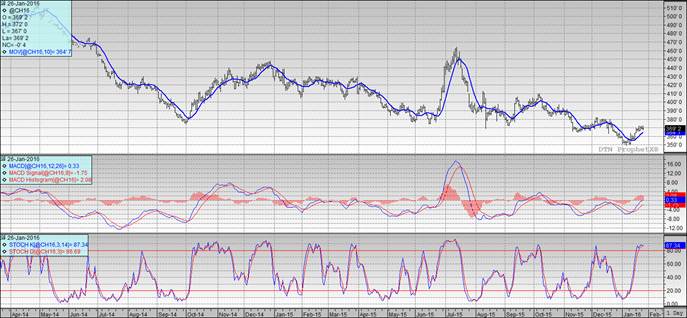

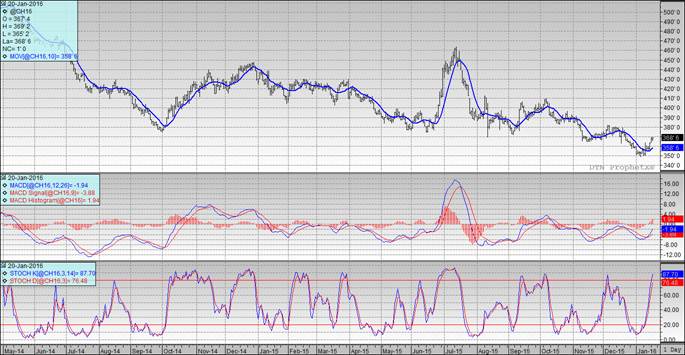

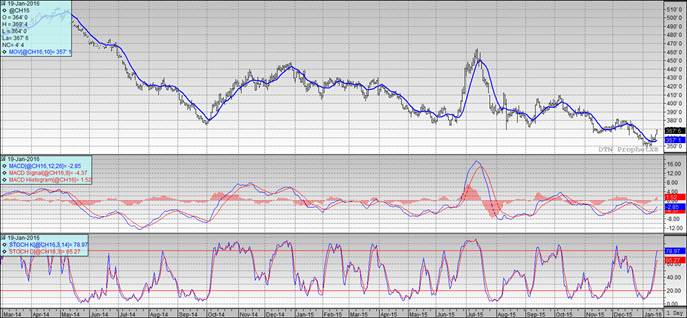

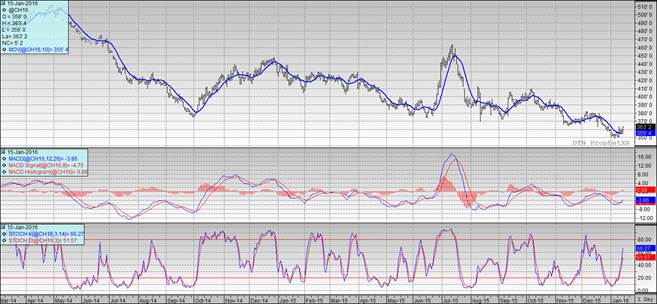

Corn:

Corn was on the defensive today with the nearby’s managing to close unchanged while the deferred months lost ground. Ethanol production was down for the 2nd week in a row. Now at 961,000 barrels/day (down 22,000 from last week) Stocks; however, were down for the first time in a while.